Are you planning a trip to Vietnam and wondering about the “MV Rental Tourism Tax” or how tourism taxes might affect your travel budget? SIXT.VN offers clarity and solutions for seamless travel experiences, including understanding local taxes. Our expert guidance ensures you navigate Vietnam’s tourism landscape with ease, turning potential tax concerns into smooth sailing. With SIXT.VN, uncover exceptional travel experiences tailored to your needs.

1. Understanding the Basics: What is MV Rental Tourism Tax?

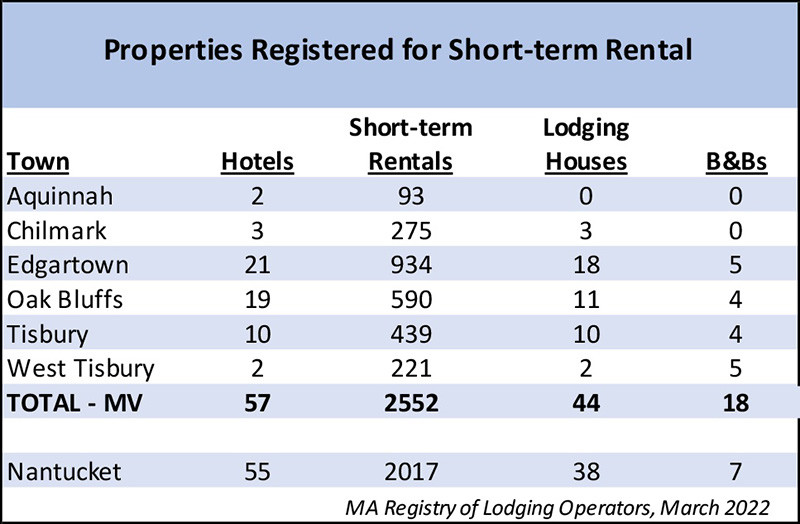

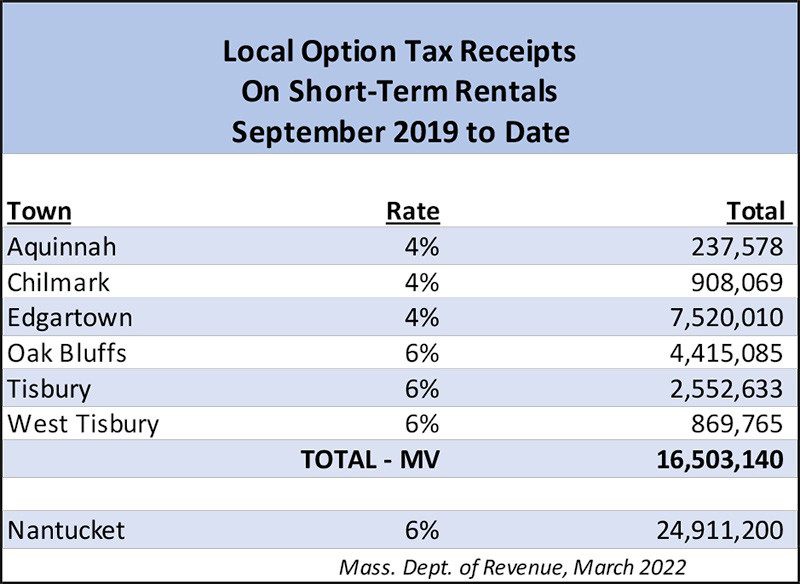

The term “MV Rental Tourism Tax,” as it relates to the original article, refers to a local option tax on short-term rentals, like those facilitated by Airbnb, specifically in Martha’s Vineyard (MV). While this tax is specific to Martha’s Vineyard in the USA, it’s important to understand the general concept of tourism taxes and how they might apply to your travels, especially in destinations like Vietnam. Therefore, it is crucial to research local regulations to guarantee compliance and budget effectively for your trip.

1.1. Decoding Tourism Taxes Globally

Tourism taxes, also known as visitor taxes, tourist taxes, or occupancy taxes, are levies imposed on tourists or visitors staying in a particular location. These taxes are typically applied to accommodation, such as hotels, resorts, and short-term rentals, and sometimes to other tourism-related services or activities.

1.2. Tourism Taxes: A Global Perspective

Tourism taxes are common worldwide, with each country and region having its own specific rules and rates. These taxes are designed to generate revenue for local governments, which can then be used to fund tourism infrastructure, promote local attractions, and support community development.

Examples of Tourism Taxes Around the World:

- Europe: Many European cities, such as Paris, Rome, and Barcelona, have city taxes that apply to hotel stays and other forms of accommodation.

- Asia: Countries like Japan and Thailand also have tourism taxes that may be included in hotel bills or airport departure fees.

- United States: In the U.S., many states and cities have lodging taxes or occupancy taxes that apply to hotels, motels, and short-term rentals.

1.3. MV Rental Tourism Tax: A Case Study

In Martha’s Vineyard, the short-term rental tax was implemented to capture revenue from the growing popularity of platforms like Airbnb and other rental aggregators. This tax consists of a state-imposed tax and a local option tax, which towns can choose to levy at a rate of up to 6%. The revenue generated from this tax is used to support local government services and infrastructure projects.

1.4. Key Aspects of the MV Rental Tourism Tax:

- Short-Term Rentals: The tax applies to rentals lasting fewer than 31 days.

- Local Option: Towns have the option to add their own tax on top of the state tax.

- Revenue Use: Funds are used for local services and infrastructure.

2. Navigating Tourism Taxes in Vietnam: What Travelers Need to Know

While the “MV Rental Tourism Tax” is specific to Martha’s Vineyard, understanding how tourism taxes work in different destinations is essential for travelers. In Vietnam, the tax landscape can be different. It’s crucial to know what taxes you might encounter and how they will affect your budget.

2.1. Understanding VAT in Vietnam

In Vietnam, Value Added Tax (VAT) is a consumption tax applied to goods and services. According to Vietnam’s Ministry of Finance, the standard VAT rate is 10%. Some goods and services may be subject to a reduced rate of 5% or be exempt from VAT altogether. This is a crucial aspect of Vietnam’s tax system that visitors should understand.

How VAT Impacts Tourists:

- Accommodation: VAT is included in the price of hotel rooms, guesthouses, and other lodging options.

- Dining: Restaurants and cafes typically include VAT in their menu prices.

- Transportation: VAT is applicable to transportation services, such as taxis, buses, and trains.

- Shopping: When purchasing goods, VAT is included in the retail price.

2.2. Other Potential Taxes and Fees

Besides VAT, tourists in Vietnam might encounter other taxes or fees, such as:

- Service Fees: Some hotels and restaurants may add a service fee, usually around 5-10%, to the bill.

- Airport Departure Tax: Although often included in the price of your airline ticket, it’s good to be aware of this fee.

2.3. Local Taxes and Charges: Stay Informed

Local taxes and charges can vary from region to region in Vietnam. Some cities or provinces may impose additional fees for specific services or attractions. It’s advisable to check with local tourism authorities or your hotel for the most up-to-date information.

2.4. Transparency in Pricing: What to Expect

In most reputable establishments in Vietnam, taxes and fees should be clearly displayed or included in the quoted price. If you’re unsure, don’t hesitate to ask for clarification. Transparency ensures you can budget accurately and avoid unexpected costs.

2.5. How SIXT.VN Simplifies Your Travel Budget

SIXT.VN is committed to providing transparent and all-inclusive pricing for our services. When you book with us, you can rest assured that all applicable taxes and fees are clearly outlined, so you can manage your travel budget effectively. No hidden costs, no surprises – just straightforward, reliable service.

Hanoi street food tax implications

Hanoi street food tax implications

3. Impact on Tourism: How Taxes Affect Travel Decisions

Tourism taxes, like the MV Rental Tourism Tax, can influence travel decisions. Understanding these impacts is essential for both travelers and tourism businesses. Let’s examine how these taxes affect the tourism industry and what factors travelers consider when planning their trips.

3.1. How Tourism Taxes Affect Travel Decisions

- Price Sensitivity: Taxes can increase the overall cost of travel, making some destinations less attractive to budget-conscious travelers.

- Destination Choice: High tax rates may deter tourists from choosing a particular location, especially if comparable destinations have lower taxes.

- Length of Stay: Tourists might shorten their stays to reduce the amount of tax they have to pay.

- Accommodation Choice: Travelers may opt for cheaper accommodation options to offset the cost of taxes.

3.2. Factors Influencing Travel Decisions

According to a study by the World Tourism Organization (UNWTO), several factors influence travel decisions. These include:

- Price and Value: Travelers seek the best value for their money, considering the overall cost of the trip.

- Safety and Security: The perceived safety and security of a destination are critical factors.

- Attractions and Activities: The availability of attractions, activities, and unique experiences.

- Accessibility: Ease of travel to and within the destination.

- Reviews and Recommendations: Online reviews and recommendations from other travelers.

3.3. Balancing Taxes and Tourism Growth

Local governments must strike a balance between generating revenue through tourism taxes and maintaining the attractiveness of their destinations. High taxes can deter visitors, while low taxes may not provide enough funding for necessary infrastructure and services.

3.4. Strategies to Mitigate Negative Impacts

To minimize the negative impacts of tourism taxes, destinations can:

- Transparency: Clearly communicate how tax revenue is used to improve the tourism experience.

- Value-Added Services: Offer additional services or amenities to justify the cost of taxes.

- Targeted Marketing: Focus on attracting higher-spending tourists who are less sensitive to taxes.

- Competitive Pricing: Ensure that overall prices, including taxes, remain competitive with other destinations.

3.5. SIXT.VN’s Approach to Affordable Travel

At SIXT.VN, we understand the importance of affordable travel. That’s why we strive to offer competitive prices and transparent pricing policies. Our services are designed to provide excellent value for money, ensuring that you can enjoy your trip to Vietnam without breaking the bank.

4. Local Option Taxes: The Power of Local Governance

Local option taxes, like the one discussed in the context of the MV Rental Tourism Tax, give municipalities the power to levy additional taxes on specific services. This can be a powerful tool for local governance, but it also requires careful consideration and planning. Let’s delve into the details of local option taxes and how they work.

4.1. Understanding Local Option Taxes

Local option taxes are taxes that local governments, such as cities, counties, or towns, have the authority to impose in addition to state or national taxes. These taxes are typically applied to specific goods or services, such as hotel stays, restaurant meals, or short-term rentals.

4.2. How Local Option Taxes Work

- Enabling Legislation: State laws or regulations must authorize local governments to impose these taxes.

- Local Decision-Making: Local governments decide whether to implement the tax, at what rate, and how the revenue will be used.

- Revenue Allocation: The revenue generated from local option taxes is typically earmarked for specific purposes, such as funding local infrastructure, schools, or tourism promotion.

4.3. Examples of Local Option Taxes

- Hotel Occupancy Taxes: Many cities and counties impose taxes on hotel stays, with the revenue used to support local tourism initiatives.

- Restaurant Taxes: Some local governments tax restaurant meals, with the funds often used to support local schools or community projects.

- Sales Taxes: In some states, local governments can add their own sales tax on top of the state sales tax.

4.4. Benefits of Local Option Taxes

- Revenue Generation: Provides local governments with an additional source of revenue to fund essential services.

- Local Control: Allows local communities to make decisions about taxation and spending that align with their priorities.

- Targeted Funding: Revenue can be directed to specific projects or programs that benefit the local community.

4.5. Challenges of Local Option Taxes

- Economic Impact: High local taxes can make a destination less competitive, potentially deterring tourists and businesses.

- Administrative Complexity: Implementing and managing local taxes can be complex, requiring additional resources and expertise.

- Public Acceptance: Local residents and businesses may resist new taxes, especially if they perceive them as unfair or burdensome.

4.6. SIXT.VN: Partnering with Local Communities

SIXT.VN is committed to being a responsible corporate citizen in the communities where we operate. We understand the importance of local taxes in funding essential services and infrastructure. That’s why we work closely with local governments to ensure that we comply with all applicable tax laws and regulations. By partnering with local communities, we help support sustainable tourism and economic development.

Vietnam tourism development tax planning

Vietnam tourism development tax planning

5. Maximizing Revenue: Strategies for Local Governments

Local governments need to adopt effective strategies to maximize revenue from tourism taxes while maintaining a competitive edge. Let’s explore some of these strategies and how they can benefit both the local economy and the tourism industry.

5.1. Setting the Right Tax Rate

- Market Research: Conduct thorough market research to determine the optimal tax rate that maximizes revenue without deterring tourists.

- Competitive Analysis: Compare tax rates with those of competing destinations to ensure competitiveness.

- Economic Impact Assessment: Assess the potential economic impact of different tax rates on local businesses and tourism.

5.2. Effective Tax Collection

- Compliance Programs: Implement robust compliance programs to ensure that all businesses collect and remit taxes accurately and on time.

- Technology Solutions: Use technology solutions to streamline tax collection and reporting processes.

- Education and Outreach: Provide education and outreach to businesses to help them understand their tax obligations.

5.3. Transparency and Accountability

- Public Reporting: Publish regular reports on tax revenue and how it is being used to benefit the community.

- Community Engagement: Engage with the community to gather input on how tax revenue should be allocated.

- Oversight Mechanisms: Establish oversight mechanisms to ensure that tax revenue is used efficiently and effectively.

5.4. Investing in Tourism Infrastructure

- Infrastructure Development: Invest tax revenue in improving tourism infrastructure, such as roads, airports, and public transportation.

- Attraction Development: Develop new attractions and activities to attract more tourists and increase revenue.

- Marketing and Promotion: Invest in marketing and promotion to raise awareness of the destination and attract visitors.

5.5. Supporting Local Businesses

- Business Development Programs: Offer business development programs to help local businesses grow and thrive.

- Incentives and Grants: Provide incentives and grants to encourage businesses to invest in improvements and expansions.

- Partnerships: Foster partnerships between local businesses and tourism organizations to promote collaboration and innovation.

5.6. SIXT.VN: Contributing to Local Economies

SIXT.VN is dedicated to contributing to the economic well-being of the communities we serve. We pay all applicable taxes and fees, and we support local businesses through partnerships and collaborations. By working together, we can create a vibrant and sustainable tourism industry that benefits everyone.

6. The Future of Tourism Taxes: Trends and Predictions

The landscape of tourism taxes is constantly evolving. As the tourism industry continues to grow and change, new trends and challenges are emerging. Let’s take a look at the future of tourism taxes and what we can expect in the years to come.

6.1. Rise of Digital Taxes

- Online Platforms: As more travel bookings are made through online platforms like Airbnb and Booking.com, governments are looking to tax these transactions.

- Digital Nomad Taxes: With the rise of digital nomads, some countries are exploring ways to tax remote workers who stay for extended periods.

6.2. Environmental Taxes

- Carbon Taxes: Some destinations are considering carbon taxes on air travel and other activities that contribute to climate change.

- Ecotaxes: Ecotaxes are levied on activities that harm the environment, such as excessive water usage or pollution.

6.3. Impact-Based Taxes

- Overcrowding Taxes: Destinations struggling with overcrowding may impose taxes on visitors during peak seasons to manage the impact on local communities.

- Infrastructure Taxes: Taxes may be levied to fund specific infrastructure projects needed to support tourism growth.

6.4. Data-Driven Tax Policies

- Real-Time Data: Governments are using real-time data to monitor tourism activity and adjust tax policies accordingly.

- Dynamic Pricing: Dynamic pricing models are being used to adjust tax rates based on demand and other factors.

6.5. Increased Transparency and Accountability

- Public Disclosure: There is growing pressure for governments to be more transparent about how tourism tax revenue is used.

- Stakeholder Engagement: Governments are engaging with stakeholders, including local communities and tourism businesses, to develop tax policies that are fair and effective.

6.6. SIXT.VN: Adapting to the Future

SIXT.VN is committed to staying ahead of the curve when it comes to tourism tax trends. We continuously monitor changes in tax laws and regulations, and we adapt our business practices accordingly. Our goal is to provide our customers with accurate and up-to-date information so they can make informed decisions about their travel plans.

7. Practical Tips for Travelers: Managing Tourism Taxes

Navigating tourism taxes can be tricky, but with a few practical tips, you can manage them effectively and avoid surprises. Here are some helpful strategies for travelers to keep in mind.

7.1. Research Destination Taxes

- Pre-Trip Research: Before you travel, research the taxes and fees that apply to tourists in your destination.

- Official Sources: Check official government websites or tourism authority websites for accurate information.

- Travel Forums: Consult travel forums and online communities for insights from other travelers.

7.2. Budget for Taxes

- Include Taxes in Budget: Factor taxes and fees into your overall travel budget.

- Estimate Costs: Estimate the potential costs of taxes based on your travel plans and accommodation choices.

- Contingency Fund: Set aside a contingency fund to cover unexpected taxes or fees.

7.3. Ask About Taxes and Fees

- Transparency: Ask hotels, restaurants, and other service providers to clearly state all applicable taxes and fees.

- Clarification: If you’re unsure about any charges, don’t hesitate to ask for clarification.

- Written Confirmation: Request written confirmation of all taxes and fees to avoid misunderstandings.

7.4. Consider Accommodation Options

- Tax-Inclusive Rates: Look for accommodation options that offer tax-inclusive rates.

- Budget Accommodation: Consider budget-friendly accommodation options to reduce your overall tax burden.

- Alternative Accommodation: Explore alternative accommodation options, such as vacation rentals, which may have different tax implications.

7.5. Take Advantage of Tax Refunds

- VAT Refunds: In some countries, tourists may be eligible for VAT refunds on certain purchases.

- Research Eligibility: Research the eligibility requirements and procedures for claiming VAT refunds.

- Keep Receipts: Keep all receipts and documentation to support your refund claim.

7.6. SIXT.VN: Your Travel Partner

SIXT.VN is here to help you navigate the complexities of travel. Our team of experts can provide you with information on taxes, fees, and other travel-related issues. We’re committed to making your trip to Vietnam as smooth and enjoyable as possible.

8. Case Studies: Examining Successful Tourism Tax Models

Looking at successful tourism tax models can provide valuable insights for local governments and tourism businesses. Let’s explore a few case studies of destinations that have implemented effective tourism tax policies.

8.1. Amsterdam, Netherlands

- Tourism Tax Model: Amsterdam charges a tourist tax per person per night, as well as a percentage of the room rate.

- Revenue Use: Revenue is used to fund tourism infrastructure, cultural events, and sustainability initiatives.

- Success Factors: Transparency, community engagement, and targeted investment in tourism infrastructure.

8.2. Kyoto, Japan

- Tourism Tax Model: Kyoto introduced a accommodation tax on hotel stays, with rates varying depending on the price of the room.

- Revenue Use: Revenue is used to preserve historical sites, improve public transportation, and enhance the visitor experience.

- Success Factors: Clear objectives, stakeholder collaboration, and a focus on preserving cultural heritage.

8.3. Barcelona, Spain

- Tourism Tax Model: Barcelona charges a tourist tax on hotel stays and cruise ship visits, with rates varying depending on the type of accommodation and length of stay.

- Revenue Use: Revenue is used to fund tourism promotion, infrastructure projects, and sustainable tourism initiatives.

- Success Factors: Sustainable tourism focus, public-private partnerships, and investment in infrastructure.

8.4. Lessons Learned

- Transparency is Key: Clearly communicate how tax revenue is used to benefit the community and enhance the visitor experience.

- Stakeholder Engagement: Engage with stakeholders, including local communities and tourism businesses, to develop tax policies that are fair and effective.

- Targeted Investment: Invest tax revenue in projects and programs that support sustainable tourism and benefit the local economy.

8.5. SIXT.VN: Learning from the Best

SIXT.VN is committed to learning from the best practices in the tourism industry. We continuously monitor successful tourism tax models and adapt our business practices accordingly. Our goal is to contribute to sustainable tourism and support the economic well-being of the communities we serve.

9. SIXT.VN Services: Making Travel to Vietnam Easier

At SIXT.VN, we offer a range of services designed to make your trip to Vietnam easier and more enjoyable. From airport transfers to hotel bookings and guided tours, we’ve got you covered. Let’s take a closer look at our services and how they can benefit you.

9.1. Airport Transfers

- Seamless Arrival: Start your trip off right with our reliable airport transfer service.

- Professional Drivers: Our professional drivers will meet you at the airport and take you to your hotel in comfort and style.

- Fixed Rates: Enjoy fixed rates with no hidden fees, so you can budget accurately.

9.2. Hotel Bookings

- Wide Selection: Choose from a wide selection of hotels to suit your budget and preferences.

- Competitive Rates: We offer competitive rates on hotels in top destinations throughout Vietnam.

- Easy Booking: Our easy-to-use booking platform makes it simple to find and book the perfect hotel for your trip.

9.3. Guided Tours

- Expert Guides: Our expert guides will take you on unforgettable tours of Vietnam’s top attractions.

- Customized Itineraries: We can create customized itineraries to suit your interests and preferences.

- Immersive Experiences: Immerse yourself in the local culture and discover the hidden gems of Vietnam.

9.4. Car Rental

- Wide Range of Vehicles: Choose from a wide range of vehicles to suit your needs.

- Affordable Rates: We offer affordable rates and flexible rental options.

- Convenient Locations: Pick up and drop off your rental car at convenient locations throughout Vietnam.

9.5. Travel Insurance

- Peace of Mind: Travel with peace of mind knowing that you’re protected by our comprehensive travel insurance.

- Coverage Options: We offer a range of coverage options to suit your needs.

- 24/7 Assistance: Our 24/7 assistance hotline is available to help you in case of emergencies.

9.6. Why Choose SIXT.VN?

- Reliable Service: We’re committed to providing reliable and professional service.

- Transparent Pricing: We offer transparent pricing with no hidden fees.

- Customer Support: Our customer support team is available to assist you with any questions or concerns.

With SIXT.VN, you can relax and enjoy your trip to Vietnam knowing that you’re in good hands.

10. Frequently Asked Questions (FAQs) About MV Rental Tourism Tax and Tourism in Vietnam

Here are some frequently asked questions about tourism taxes and traveling in Vietnam to help you better understand and plan your trip.

10.1. What is the MV Rental Tourism Tax?

The MV Rental Tourism Tax is a local option tax on short-term rentals in Martha’s Vineyard, consisting of a state tax and a local tax that towns can levy.

10.2. How does VAT affect tourists in Vietnam?

VAT is included in the price of most goods and services in Vietnam, including accommodation, dining, transportation, and shopping.

10.3. Are there any other taxes or fees that tourists might encounter in Vietnam?

Tourists in Vietnam may encounter service fees at hotels and restaurants, as well as potential airport departure taxes.

10.4. How can I manage tourism taxes effectively when traveling?

Research destination taxes, budget for taxes, ask about taxes and fees, consider accommodation options, and take advantage of tax refunds.

10.5. What factors influence travel decisions, according to the UNWTO?

Price and value, safety and security, attractions and activities, accessibility, and reviews and recommendations.

10.6. How can local governments maximize revenue from tourism taxes?

By setting the right tax rate, ensuring effective tax collection, maintaining transparency and accountability, investing in tourism infrastructure, and supporting local businesses.

10.7. What are some of the future trends in tourism taxes?

The rise of digital taxes, environmental taxes, impact-based taxes, data-driven tax policies, and increased transparency and accountability.

10.8. What services does SIXT.VN offer to make travel to Vietnam easier?

SIXT.VN offers airport transfers, hotel bookings, guided tours, car rental, and travel insurance.

10.9. How does SIXT.VN contribute to local economies in Vietnam?

By paying all applicable taxes and fees and supporting local businesses through partnerships and collaborations.

10.10. Where can I find more information about tourism taxes and traveling in Vietnam?

Check official government websites, tourism authority websites, travel forums, and consult with travel experts like SIXT.VN.

Address: 260 Cau Giay, Hanoi, Vietnam

Hotline/Whatsapp: +84 986 244 358

Website: SIXT.VN

By understanding these frequently asked questions, you can better prepare for your travels in Vietnam and manage any potential tax-related concerns. Enjoy your trip!