Jetblue Travel Bank is your digital wallet for travel credits when you cancel a JetBlue flight, and SIXT.VN can guide you through maximizing its benefits for your next adventure. This virtual account holds the value of your unused tickets, ready to be applied to future flights or JetBlue Vacations packages, ensuring your travel plans remain flexible and cost-effective. Plan your next trip to Vietnam with ease, utilizing your travel credits for a seamless travel booking and a dream vacation.

1. Understanding the JetBlue Travel Bank

The JetBlue Travel Bank is a system designed by JetBlue to hold travel credits issued to customers who cancel their flights. It acts as a virtual account where the value of your ticket is stored, ready for use on future JetBlue flights or vacation packages.

1.1. What is the JetBlue Travel Bank?

The JetBlue Travel Bank is essentially an electronic holding place for travel credits. When you cancel a JetBlue flight (excluding Blue Basic fares, which have cancellation fees), the value of your ticket is converted into a credit and stored in your Travel Bank. This credit can then be used to book future flights or JetBlue Vacations packages. This system ensures that you don’t lose the money you’ve already spent, providing a flexible way to manage your travel plans. According to JetBlue’s official website, the Travel Bank is designed to simplify the process of managing travel credits, making it easier for customers to rebook their flights.

1.2. How Does the JetBlue Travel Bank Work?

The Travel Bank system is linked to your JetBlue TrueBlue account or, if you don’t have one, to the email address you used when booking your original flight. When you cancel a flight, the credit is automatically deposited into your Travel Bank. To use the credit, you simply log into your TrueBlue account or access your Travel Bank using the provided credentials during the booking process for a new flight or vacation package. The system then applies the credit towards your new purchase. JetBlue’s user-friendly interface ensures a seamless experience, allowing you to easily view your balance and apply credits.

1.3. Benefits of Using the JetBlue Travel Bank

Using the JetBlue Travel Bank offers several advantages. First and foremost, it provides flexibility. You don’t lose the value of your ticket if you need to cancel your flight; instead, you can use it for future travel. Additionally, the Travel Bank simplifies the booking process by automatically applying your credits, saving you time and effort. It also allows you to book flights for others, making it a convenient option for families or groups. According to a study by the U.S. Department of Transportation, flexible booking options are a key factor in customer satisfaction with airlines.

2. JetBlue Travel Bank Rules and Restrictions

While the JetBlue Travel Bank is a useful tool, it’s essential to understand its rules and restrictions to avoid any surprises.

2.1. Non-Transferable Credits

One of the key restrictions of the JetBlue Travel Bank is that the credits are non-transferable. This means you cannot transfer your credits to another person’s account. However, you can use your credits to book a flight for someone else. As long as you are logged into your Travel Bank account during the booking process, the name on the ticket does not need to match the name on the account. This allows you to use your credits for family members, friends, or anyone else you choose.

2.2. Payment Limitations

JetBlue allows you to use Travel Bank credits to pay for any type of fare, but there’s a limitation when it comes to award tickets. If you’re using points to book a flight and want to use your Travel Bank credits to cover the taxes and fees, the credit must be sufficient to cover the entire amount. This is because JetBlue only allows two forms of payment per ticket. If one of those forms is points, the other must cover the full cash amount. This can be a significant limitation, especially when changing award tickets, as any taxes and fees paid on the original ticket will be deposited into your Travel Bank, potentially leaving you unable to use those credits for the new ticket if the taxes and fees are higher.

2.3. Expiration Dates

JetBlue Travel Bank credits have a strict expiration date: 12 months from the original ticketing date (the date you booked the original ticket). It’s crucial to be aware of this date, as you will lose your credits if you don’t use them within this timeframe. You only need to book a new ticket using the credit before it expires; the actual flight can be scheduled for a later date. JetBlue typically opens its schedule nearly a year in advance, so you can book a flight well into the future as long as you do so before the credit expires.

JetBlue TrueBlue Travel Bank

JetBlue TrueBlue Travel Bank

2.4. How to Avoid Losing Your Credits

To avoid losing your JetBlue Travel Bank credits, mark the expiration date on your calendar and plan accordingly. Regularly check your Travel Bank balance to stay informed. If you’re unsure about your travel plans, book a flight for a future date and change it later if needed (subject to any applicable fare differences). Remember, the key is to use the credit to book a flight before it expires, even if you don’t plan to travel immediately.

2.5. Impact of COVID-19 on Expiration Policies

During the COVID-19 pandemic, many airlines, including JetBlue, offered more flexible policies regarding travel credits and expiration dates. However, it’s important to note that these policies may have changed. Always check the most current terms and conditions on JetBlue’s website or contact their customer service for the latest information.

3. What Can You Use the JetBlue Travel Bank For?

The JetBlue Travel Bank can be used for a specific set of purposes. Understanding these uses will help you maximize the value of your credits.

3.1. Eligible Uses for Travel Bank Credits

You can use JetBlue Travel Bank credits for:

- Airfare and taxes on JetBlue-operated flights booked through JetBlue’s website or mobile app.

- Taxes and fees on JetBlue award flights (as long as the credit covers the entire amount).

- The air portion of a JetBlue Vacations package.

- Any applicable increase in airfare when changing a booking.

3.2. Ineligible Uses for Travel Bank Credits

You cannot use JetBlue Travel Bank credits for:

- Checked baggage fees

- In-cabin pet fees

- Seat selection fees

- Other ancillary fees

Essentially, the Travel Bank is primarily for airfare-related expenses.

3.3. Maximizing the Value of Your Credits

To maximize the value of your JetBlue Travel Bank credits, use them for flights or vacation packages where the airfare constitutes a significant portion of the total cost. Avoid using them for award flights if the taxes and fees are relatively low, as you may be better off saving the credits for a more expensive flight. Also, consider using your credits to cover any increase in airfare when changing a booking, as this can help offset the cost of the change.

4. How to Check Your JetBlue Travel Bank Balance

Checking your JetBlue Travel Bank balance is a simple process.

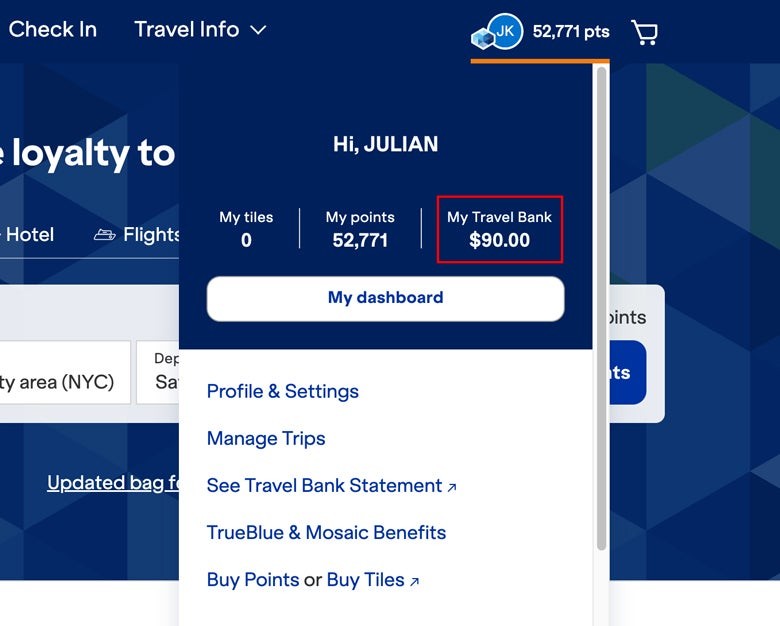

4.1. Accessing Your Balance Through TrueBlue Account

If you have a JetBlue TrueBlue frequent flyer account, you can easily check your Travel Bank balance by logging into your account on JetBlue’s website. Once logged in, click on the account menu in the upper right corner to view your balance. The Travel Bank balance is displayed alongside your TrueBlue points balance.

4.2. Accessing Your Balance Without a TrueBlue Account

If you don’t have a TrueBlue account, JetBlue sends you two separate welcome emails after you cancel your ticket. These emails contain the login information for your Travel Bank, including a temporary password that you’ll need to change within 48 hours. You can use this information to log in to your Travel Bank account and view your current balance and expiration date.

4.3. Recovering Login Information

If you can’t find the welcome emails or forgot to change your temporary password, you can use JetBlue’s Login Lookup Form to retrieve your login information. Simply enter the email address you used when booking your original flight, and JetBlue will send you instructions on how to access your Travel Bank account.

5. How to Use a JetBlue Travel Bank Credit

Using a JetBlue Travel Bank credit is straightforward, whether you’re booking a flight with cash or points.

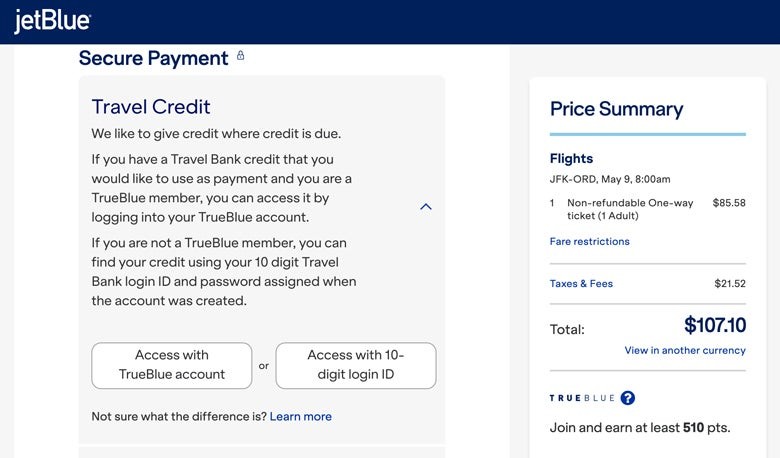

5.1. Using Credits When Booking with Cash

When booking a flight with cash on JetBlue’s website or app, search for the new flight you want to book. On the payment page, you’ll have the option to log in to your TrueBlue account to apply your Travel Bank credit (if you aren’t already logged in). Alternatively, you can access your Travel Bank using the login information provided by JetBlue.

JetBlue apply Travel Bank credit

JetBlue apply Travel Bank credit

5.2. Partial Payment Options

You don’t have to use your entire Travel Bank credit all at once. If your ticket costs less than the credit, the remaining amount will stay in your Travel Bank for future use. You can also choose to use only a portion of your credit and pay the remaining amount with a credit card. This flexibility allows you to manage your credits according to your needs.

5.3. Using Credits When Booking with Points

If you’re booking with points, you’ll have the same opportunity to use your Travel Bank credits toward the taxes and fees on your award flight. However, remember that the credit must be able to cover the entire amount of taxes and fees, as JetBlue only allows two forms of payment per ticket.

6. Extending a JetBlue Travel Bank Credit

Unfortunately, there is no way to extend the expiration date on a JetBlue Travel Bank credit.

6.1. No Extensions Allowed

JetBlue does not offer extensions on Travel Bank credits, regardless of your elite status or other circumstances. The 12-month expiration clock starts from the date you booked the original ticket, and it cannot be reset.

6.2. Impact of Rebooking and Canceling

If you book a new ticket with the credit and then cancel that new ticket, the credit will retain its original expiration date. If the original expiration date has passed, you will not get the credit back. This policy is less customer-friendly than those of some other airlines, which may reset the expiration date when you rebook.

6.3. Strategies to Avoid Expiration

Since you cannot extend the expiration date, the best strategy is to plan ahead and use your credits before they expire. Book a flight for a future date, even if you’re not sure about your travel plans. You can always change the flight later, but at least you’ll have used the credit before it expires.

7. JetBlue Mosaic Elite Status and Travel Bank Credits

Having JetBlue Mosaic elite status does not exempt you from the Travel Bank credit expiration policy.

7.1. Mosaic Status Benefits

JetBlue Mosaic is JetBlue’s elite status program, offering benefits such as priority boarding, free checked bags, and extra legroom. However, Mosaic status does not provide any special privileges regarding Travel Bank credits.

7.2. Travel Bank Policies for Mosaic Members

Mosaic members are subject to the same Travel Bank rules and restrictions as all other JetBlue customers. This includes the 12-month expiration date and the inability to extend credits.

7.3. Maximizing Mosaic Benefits with Travel Bank Credits

While Mosaic status doesn’t directly impact Travel Bank credits, you can still maximize your Mosaic benefits when using your credits. For example, you can use your credits to book a flight and then take advantage of your free checked bags and priority boarding as a Mosaic member.

8. Comparing JetBlue Travel Bank to Other Airlines

The JetBlue Travel Bank has both advantages and disadvantages compared to similar programs offered by other airlines.

8.1. Southwest Airlines

Southwest Airlines is known for its customer-friendly policies, including no expiration dates on travel credits. This is a significant advantage over JetBlue, as you don’t have to worry about losing your credits if your travel plans change.

8.2. Delta Air Lines

Delta Air Lines typically offers more flexibility with travel credits than JetBlue. In many cases, Delta will allow you to extend the expiration date of your credits or transfer them to another person.

8.3. United Airlines

United Airlines’ travel credit policies are generally similar to JetBlue’s, with a 12-month expiration date and limited options for extending or transferring credits.

8.4. Key Differences and Advantages

The key differences between JetBlue’s Travel Bank and other airlines’ programs lie in the expiration dates and the flexibility to extend or transfer credits. Southwest’s no-expiration policy is the most customer-friendly, while JetBlue’s policies are more restrictive. However, JetBlue’s Travel Bank is still a valuable tool for managing travel credits and offers a convenient way to use the value of your unused tickets.

9. Potential Improvements to the JetBlue Travel Bank

While the JetBlue Travel Bank is a useful system, there are several potential improvements that could make it even better.

9.1. Extending Expiration Dates

One of the most significant improvements would be to extend or eliminate expiration dates on Travel Bank credits. This would provide customers with more flexibility and reduce the risk of losing their credits.

9.2. Allowing Transfers

Allowing customers to transfer Travel Bank credits to other people would also be a valuable improvement. This would make the credits more useful for families and groups and provide more options for customers who are unable to use the credits themselves.

9.3. Expanding Eligible Uses

Expanding the eligible uses for Travel Bank credits to include ancillary fees such as baggage fees and seat selection fees would also enhance the value of the program.

9.4. Streamlining the Booking Process

Streamlining the booking process and making it easier to apply Travel Bank credits would improve the overall customer experience. This could include providing clearer instructions and a more user-friendly interface.

10. Final Thoughts on the JetBlue Travel Bank

The JetBlue Travel Bank is a valuable tool for managing travel credits and provides a convenient way to use the value of your unused tickets. However, it’s essential to understand the rules and restrictions of the program to avoid any surprises. By being aware of the expiration dates, payment limitations, and other policies, you can maximize the value of your credits and ensure a smooth travel experience.

10.1. Key Takeaways

- JetBlue Travel Bank credits are non-transferable but can be used to book flights for others.

- Credits can be used to pay for any type of JetBlue fare, but there are limitations when using them for award tickets.

- Travel Bank credits expire 12 months after the original ticketing date.

- There is no way to extend the expiration date on a JetBlue Travel Bank credit.

- Having JetBlue Mosaic elite status does not exempt you from the Travel Bank credit expiration policy.

10.2. Booking Your Trip to Vietnam

Consider booking your trip to Vietnam with SIXT.VN. With SIXT.VN, you can explore the beauty of Vietnam with ease and comfort. We offer a range of services tailored to meet your needs, ensuring a seamless and memorable travel experience. Our services include:

- Hanoi Airport Transfer: Start your trip stress-free with our reliable and comfortable airport transfer service. Our professional drivers will greet you upon arrival and ensure a smooth journey to your hotel.

- Hanoi Car Rental: Explore Hanoi and its surroundings at your own pace with our car rental service. We offer a variety of vehicles to suit your needs, from compact cars to spacious SUVs.

- Hanoi Private Tours: Discover the best of Hanoi with our private tours. Our knowledgeable guides will take you to the city’s most iconic landmarks and hidden gems, providing you with a unique and personalized experience.

10.3. Booking Flights with JetBlue

When booking flights with JetBlue, remember to use your Travel Bank credits to save money on your airfare. Keep track of your credit balance and expiration date, and plan your travel accordingly. By following these tips, you can make the most of your JetBlue Travel Bank and enjoy affordable and flexible travel.

FAQ: JetBlue Travel Bank

1. What is the JetBlue Travel Bank?

The JetBlue Travel Bank is a virtual account where JetBlue stores travel credits issued to customers who cancel their flights. It allows you to use the value of your unused tickets for future JetBlue flights or vacation packages.

2. How do I check my JetBlue Travel Bank balance?

You can check your balance by logging into your JetBlue TrueBlue account or, if you don’t have one, by using the login information sent to you in the welcome emails after you canceled your flight.

3. Can I transfer my JetBlue Travel Bank credits to someone else?

No, JetBlue Travel Bank credits are non-transferable. However, you can use your credits to book a flight for someone else.

4. What can I use my JetBlue Travel Bank credits for?

You can use your credits for airfare and taxes on JetBlue-operated flights, taxes and fees on JetBlue award flights (if the credit covers the entire amount), the air portion of a JetBlue Vacations package, and any applicable increase in airfare when changing a booking.

5. What can’t I use my JetBlue Travel Bank credits for?

You cannot use your credits for checked baggage fees, in-cabin pet fees, seat selection fees, or other ancillary fees.

6. How long are JetBlue Travel Bank credits valid?

JetBlue Travel Bank credits are valid for 12 months from the original ticketing date (the date you booked the original ticket).

7. Can I extend the expiration date on my JetBlue Travel Bank credits?

No, there is no way to extend the expiration date on a JetBlue Travel Bank credit.

8. What happens if I book a new ticket with my Travel Bank credits and then cancel that ticket?

The credit will retain its original expiration date. If the original expiration date has passed, you will not get the credit back.

9. Does having JetBlue Mosaic elite status exempt me from the Travel Bank credit expiration policy?

No, having JetBlue Mosaic elite status does not exempt you from the Travel Bank credit expiration policy.

10. Can I use my JetBlue Travel Bank credits to pay for the entire cost of a flight booked with points?

You can use your credits to pay for the taxes and fees on your award flight, but the credit must be able to cover the entire amount, as JetBlue only allows two forms of payment per ticket.

Make Your Travel Dreams a Reality with SIXT.VN

Ready to explore Vietnam? Let SIXT.VN be your trusted partner in planning your perfect getaway. Whether you need reliable airport transfers, flexible car rentals, or personalized tour experiences, we have you covered. Visit our website or contact us today to start planning your adventure.

Address: 260 Cau Giay, Hanoi, Vietnam

Hotline/Whatsapp: +84 986 244 358

Website: SIXT.VN