Are you wondering How Much To Charge For Travel Fees when offering your services in Vietnam? SIXT.VN provides a comprehensive guide to help you calculate appropriate travel fees, ensuring your profitability and client satisfaction. By understanding the nuances of travel costs in Vietnam, you can expand your service area while maintaining a fair and transparent pricing structure.

1. What is a Travel Fee and Why is it Important in Vietnam?

A travel fee is an additional charge added to your base service price to compensate for the costs associated with traveling to a client’s location. In the context of tourism and service provision in Vietnam, where distances can be significant and transportation infrastructure varies, travel fees are crucial for covering expenses like fuel, time, and vehicle maintenance.

According to a report by the Vietnam National Administration of Tourism (VNAT), transportation costs are a significant factor influencing the overall expense of travel services. Implementing a well-calculated travel fee ensures that businesses can offer services across a wider geographic area while remaining profitable.

2. Why Do Businesses in Vietnam Charge Travel Fees?

Businesses in Vietnam charge travel fees for several key reasons:

- Covering Transportation Costs: Fuel prices, toll fees, and parking expenses can add up quickly, especially when traveling long distances to reach clients.

- Compensating for Travel Time: Time spent traveling is time that could be used for other income-generating activities. Travel fees help compensate for this lost time.

- Vehicle Maintenance: Frequent travel can lead to increased wear and tear on vehicles, requiring more frequent maintenance and repairs.

- Ensuring Profitability: Without travel fees, businesses may find it difficult to offer services in remote areas while maintaining a reasonable profit margin.

- Fairness to Local Clients: Charging travel fees ensures that clients who are located further away contribute to the additional costs incurred to serve them.

3. Should You Charge Travel Fees for Your Services in Vietnam?

Consider charging travel fees if:

- You are willing to travel outside a limited geographic area to provide services.

- You want to offer your services to a broader range of clients across Vietnam.

- You need to cover the costs associated with traveling, such as fuel, time, and vehicle maintenance.

- You want to ensure that your services remain profitable, even when traveling long distances.

According to research from the General Statistics Office of Vietnam, businesses that incorporate travel fees into their pricing models tend to have higher overall profitability due to better cost recovery.

4. Different Approaches to Calculating Travel Fees in Vietnam

There are several methods for calculating travel fees, each with its own advantages and disadvantages:

4.1 Distance-Based Travel Fees

This method calculates travel fees based on the distance traveled to reach the client. It is often the most accurate and fair way to charge for travel, as it directly reflects the costs incurred.

- Pros:

- Accurately reflects actual travel costs.

- Easy to understand and explain to clients.

- Can be customized to account for different types of vehicles or travel conditions.

- Cons:

- Requires accurate tracking of mileage.

- May be more complex to calculate than other methods.

Many SIXT.VN customers use a free travel range with distance-based fees. For example, the first 30 kilometers may be free, with a charge of 5,000 VND per kilometer for distances exceeding 30 kilometers. This ensures that travel fees are charged only when necessary and that clients are not penalized for short-distance travel.

4.2 Flat Rate Travel Fee Tiers

This method charges a fixed fee for travel based on pre-defined distance ranges. It is simpler to administer than distance-based fees but may not accurately reflect actual travel costs.

- Pros:

- Simple to understand and administer.

- Provides predictable travel fee amounts.

- Cons:

- May not accurately reflect actual travel costs.

- Can be unfair to clients who are located just outside a lower-priced tier.

- Less flexibility in accommodating varying travel conditions.

A sample flat rate travel fee structure could look like this:

| Distance | Fee |

|---|---|

| 0-25 kilometers | FREE |

| 25-50 kilometers | 100,000 VND |

| 50-100 kilometers | 250,000 VND |

4.3 Zone-Based Travel Fees

This method divides the service area into zones and charges a fixed fee for travel within each zone. It is a compromise between distance-based and flat-rate fees, offering more accuracy than flat rates while remaining relatively simple to administer.

- Pros:

- More accurate than flat-rate fees.

- Relatively simple to administer.

- Cons:

- Requires defining zones, which can be arbitrary.

- May not accurately reflect travel costs within each zone.

4.4 Percentage-Based Travel Fees

This method charges a percentage of the total service cost as a travel fee. It is the simplest method to administer but may not accurately reflect actual travel costs, especially for high-value services.

- Pros:

- Very simple to administer.

- Automatically adjusts to the service cost.

- Cons:

- May not accurately reflect actual travel costs.

- Can be unfair to clients for high-value services that require minimal travel.

5. Round-Trip or One-Way Calculation for Travel Fees in Vietnam?

The majority of businesses in Vietnam charge one-way travel fees. This means that if a client is 50 kilometers away, the travel fee is calculated based on 50 kilometers (single trip).

Calculating on a one-way basis makes it easier for clients to understand the fee structure. However, to account for the return trip, consider increasing the per-kilometer fee. Alternatively, calculating based on the round trip provides a more accurate representation of actual travel costs but may require more explanation to clients.

6. Utilizing IRS Rates for Travel Fee Calculation in Vietnam

While the IRS (Internal Revenue Service) in the United States releases standard mileage rates each year, these rates are not directly applicable to calculating travel fees in Vietnam. The IRS rates are based on the costs of operating a vehicle in the United States, which can differ significantly from those in Vietnam.

The Vietnam Ministry of Transport provides guidelines on transportation costs and vehicle operating expenses in Vietnam. This information can be used to develop a more accurate calculation of travel fees.

7. Key Factors to Consider When Calculating Travel Fees in Vietnam

When determining how much to charge for travel fees in Vietnam, consider the following factors:

7.1 Fuel Costs

Fuel prices in Vietnam can fluctuate, so it’s important to factor in the current cost per liter when calculating travel fees. Check current fuel prices at gas stations like Petrolimex or PVOIL.

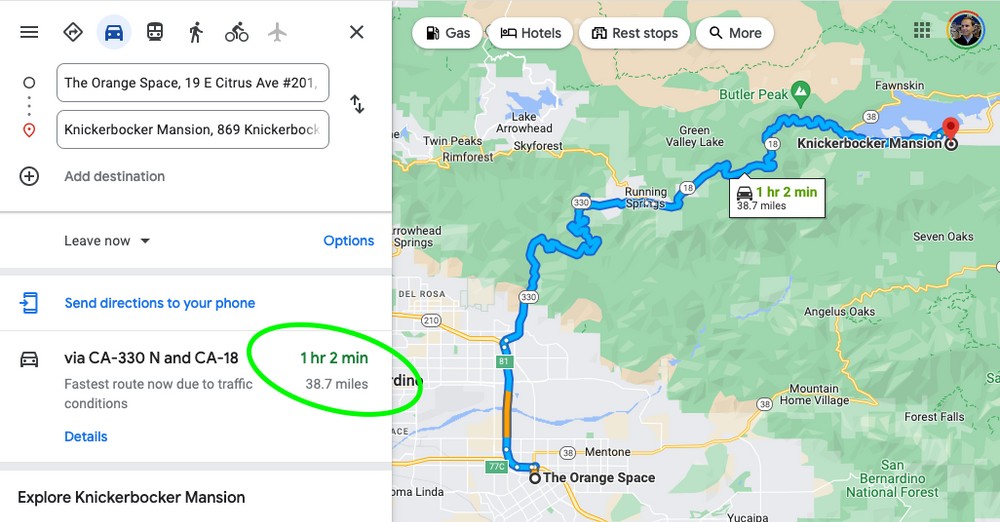

7.2 Travel Time

Time is a valuable resource, and it’s important to compensate for the time spent traveling to reach clients. Consider the hourly rate for your services and factor in the estimated travel time.

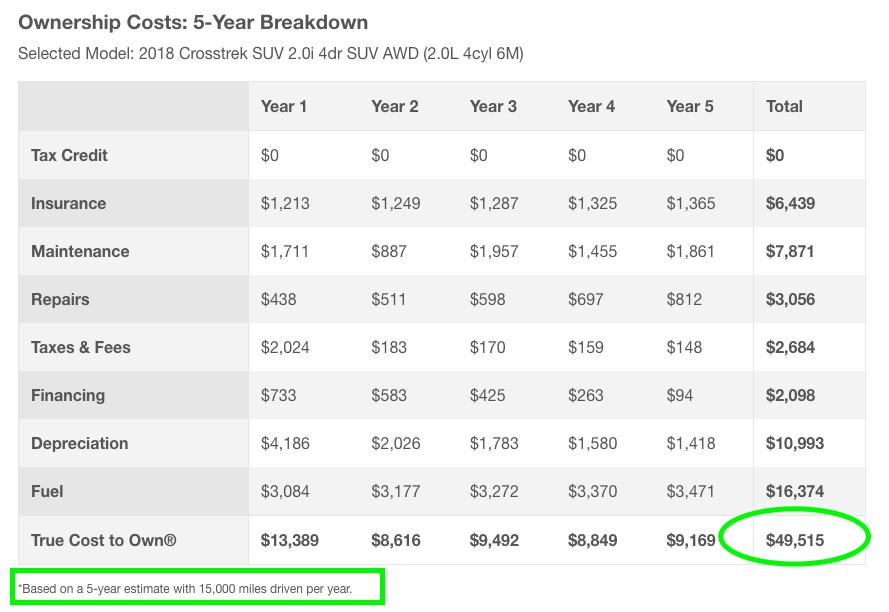

7.3 Vehicle Wear and Tear

Frequent travel can lead to increased wear and tear on your vehicle. Factor in the costs of maintenance, repairs, and depreciation when calculating travel fees.

7.4 Toll Fees

Vietnam has an extensive network of toll roads, particularly on major highways. Be sure to factor in any applicable toll fees when calculating travel fees.

7.5 Parking Fees

Parking fees can be significant in urban areas like Hanoi and Ho Chi Minh City. Consider the cost of parking when calculating travel fees, especially if you need to park near the client’s location.

7.6 Driver Costs (if applicable)

If you employ drivers, be sure to factor in their wages, benefits, and any other associated costs when calculating travel fees.

7.7 Profit Margin

While covering costs is important, it’s also essential to include a profit margin in your travel fees. This will ensure that your business remains sustainable and can continue to offer high-quality services.

8. Example Travel Fee Calculation for Hanoi

Here’s an example of how one might estimate the true costs of travel in Hanoi:

Fuel:

- Cost per liter of fuel: 25,000 VND

- Liters per kilometer: 0.1 (assuming 10 kilometers per liter)

- Fuel cost per kilometer: 2,500 VND

Wear & Tear:

- Estimated vehicle wear and tear: 4,000,000 VND per year

- Kilometers driven per year: 15,000

- Wear and tear per kilometer: 267 VND

Staff Costs:

- Hourly rate: 150,000 VND

- Average speed in Hanoi: 30 kilometers per hour

- Cost per kilometer: 5,000 VND (150,000 VND / 30 km)

Total Estimated Travel Fee:

- 2,500 VND (Fuel) + 267 VND (Wear & Tear) + 5,000 VND (Staff Costs) = 7,767 VND per kilometer

You might round this up to 8,000 VND or 10,000 VND per kilometer to account for profit margin and other miscellaneous expenses.

9. Automating Travel Fee Calculations

To simplify travel fee calculations, consider using software or online tools that automate the process. Many booking and scheduling platforms offer built-in travel fee calculation features.

SIXT.VN is continuously developing and improving our services to make it easy for you to calculate and charge travel fees, create multiple travel zones, limit bookings outside your service area, and more. Please contact us for further support.

10. Best Practices for Communicating Travel Fees to Clients in Vietnam

Transparency is key when it comes to travel fees. Be sure to clearly communicate your travel fee policy to clients upfront, before they book your services. Here are some best practices:

- Include travel fee information on your website and booking forms.

- Provide a detailed breakdown of how travel fees are calculated.

- Be upfront about any additional fees, such as toll fees or parking fees.

- Answer any questions that clients may have about travel fees.

- Consider offering a discount or waiver of travel fees for repeat clients or large bookings.

FAQ: Frequently Asked Questions About Travel Fees in Vietnam

1. Is it customary to charge travel fees in Vietnam?

Yes, it is common practice to charge travel fees for services that require travel to the client’s location.

2. How do I determine a fair travel fee for my services in Vietnam?

Consider factors such as fuel costs, travel time, vehicle wear and tear, and your desired profit margin.

3. Should I charge travel fees for local clients?

Consider offering a free travel range or a lower travel fee for local clients to encourage local business.

4. How do I handle travel fees for international clients?

Be transparent about your travel fee policy and provide a clear explanation of how fees are calculated.

5. What are the legal requirements for charging travel fees in Vietnam?

Ensure that you comply with all applicable tax laws and regulations when charging travel fees.

6. How can I make my travel fee policy more attractive to clients?

Consider offering discounts, waivers, or bundled packages to make your travel fee policy more appealing.

7. What are some common mistakes to avoid when charging travel fees in Vietnam?

Avoid overcharging, failing to communicate your travel fee policy, and neglecting to factor in all relevant costs.

8. How can I use travel fees to differentiate my business from competitors?

Offer competitive travel fees, transparent pricing, and excellent customer service to stand out from the competition.

9. How do I handle unexpected travel-related expenses?

Build a buffer into your travel fee calculation to account for unexpected expenses such as traffic delays or road closures.

10. What are the implications of not charging travel fees?

Failing to charge travel fees can erode your profit margin and make it difficult to offer services in remote areas.

By following these guidelines, you can effectively calculate and communicate travel fees to your clients in Vietnam, ensuring profitability and customer satisfaction. SIXT.VN is here to support you with convenient travel services.

Fuel station in Vietnam

Fuel station in Vietnam

Road in Vietnam

Road in Vietnam

Navigating the intricacies of travel fees is just one piece of the puzzle when planning a trip to Vietnam. At SIXT.VN, we understand the challenges travelers face and are dedicated to providing seamless solutions. From airport transfers and hotel bookings to curated tour packages and reliable flight arrangements, SIXT.VN offers a comprehensive suite of services designed to enhance your travel experience.

Address: 260 Cau Giay, Hanoi, Vietnam.

Hotline/Whatsapp: +84 986 244 358.

Website: SIXT.VN.