China Outbound Tourism Statistics are crucial for understanding travel trends and planning your Vietnam adventure. SIXT.VN offers reliable tourism advisory services, including convenient airport transfers, hotel booking, sightseeing tours, and flight arrangements, making your trip seamless. We help you navigate Vietnam with ease, providing unforgettable experiences and travel solutions.

1. What Is The Current State Of China’s Outbound Tourism Statistics?

The recovery of Chinese tourism has been uneven. While domestic tourism has seen a swift rebound, outbound tourism experienced a more gradual and partial growth in 2023. However, projections indicate that domestic tourism volume will surpass pre-pandemic levels in 2024, showcasing a strong recovery in local travel. According to research from the National Bureau of Statistics in 2023, domestic trips reached approximately 489 million, generating about Rmb4.9 trillion (US$679 billion) in tourism revenue. This mirrors a broader shift towards experiential spending within China.

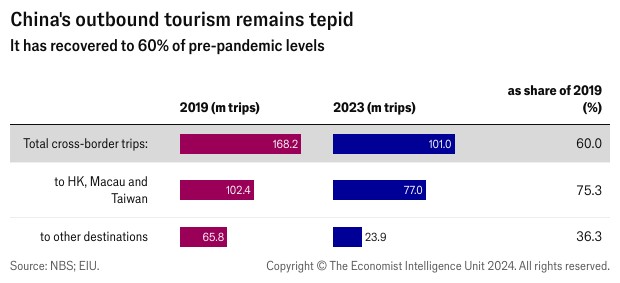

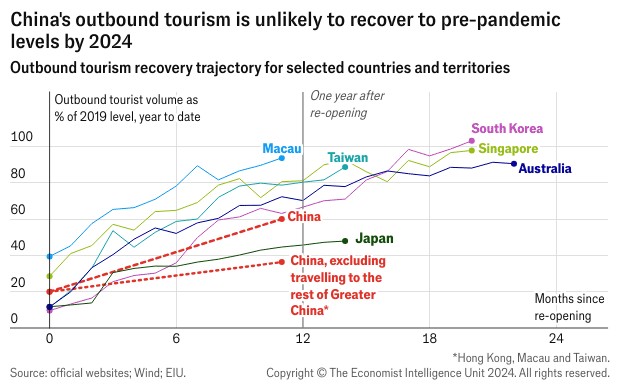

Despite the domestic tourism surge, outbound tourism is not expected to return to pre-pandemic levels until 2025. In 2023, Chinese households made 101 million cross-border trips, which is around 60% of the 2019 levels. Notably, over 70% of these trips were to Hong Kong, Macau, and Taiwan. This means that trips to other destinations only recovered to about 36.3% of 2019 levels, with approximately 2.4 million trips. Countries that opened their borders earlier, like South Korea, Australia, and Singapore, saw outbound tourism levels recover to over 65% within a year of reopening, even with COVID-related restrictions elsewhere. According to data, the United Nations World Tourism Organization (UNWTO) reports a similar trend, with global tourism showing strong signs of recovery but with regional variations.

Chinese tourism statistics showcase travel trends and recovery insights, influencing global travel strategies.

Chinese tourism statistics showcase travel trends and recovery insights, influencing global travel strategies.

2. What Factors Are Limiting The Recovery Of China Outbound Tourism?

Several factors impede the full recovery of China’s outbound tourism sector. Firstly, the stringent COVID-19 restrictions and the absence of significant household-focused subsidies during the pandemic have negatively impacted Chinese household finances. This has made households more price-sensitive, reducing demand for expensive outbound tourism options. The depreciation of China’s currency, the renminbi, coupled with high inflation rates in destination countries and a limited supply of flights and tourism services, has further increased the costs of post-COVID outbound travel.

According to a report by the World Travel & Tourism Council (WTTC) in 2023, the rising cost of travel and economic uncertainties significantly affect travel decisions. Additionally, the rapid development of domestic tourism services offers better value for money, undermining the appeal of outbound travel for many Chinese households. Policy limitations, especially increasingly complex visa application processes exacerbated by geopolitical tensions, also play a significant role. Difficult visa processes can create uncertainty in travel planning, leading to potential losses of money and time.

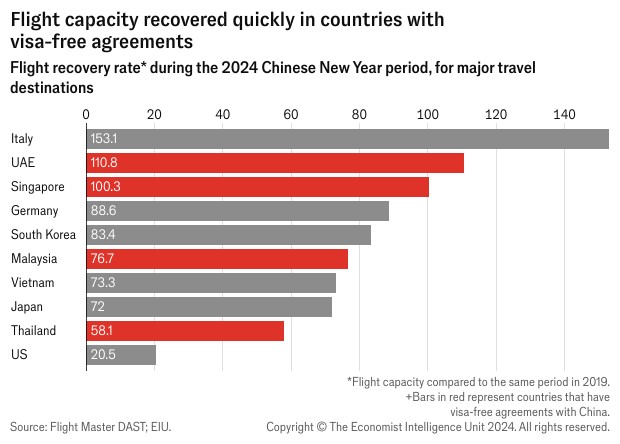

Visa waivers or simplified visa processes can significantly boost Chinese visitor arrivals. Singapore’s example, where Chinese tourist numbers increased by 45% in February following a visa waiver during the Chinese New Year holiday, illustrates this point. Countries with visa-free entry for Chinese tourists, such as Thailand, Singapore, Malaysia, and the UAE, are expected to continue seeing rising Chinese arrivals in 2024. According to the International Air Transport Association (IATA), easing travel restrictions and visa requirements are crucial for the recovery of global air travel.

Analysis of obstacles hindering Chinese outbound travel recovery: economic constraints and complex visa processes.

Analysis of obstacles hindering Chinese outbound travel recovery: economic constraints and complex visa processes.

3. How Do Domestic Policies Affect China’s Outbound Tourism Numbers?

Domestic policies in China also play a crucial role in shaping outbound tourism trends. One significant policy is the restriction on “unnecessary” outbound travel, which remains in place for employees in civil systems and state-owned enterprises. These employees account for approximately 17% of total urban employment in China, disproportionately benefiting travel to Hong Kong and Macau, which are often exempt from this policy. The need for public employees to obtain approval for overseas travel, even after the zero-COVID policy was lifted, hampers the recovery of outbound tourism, as these employees typically belong to middle- or upper-middle-income groups that are key drivers of outbound tourism.

This policy-induced inertia limits the potential for broader outbound travel, as a significant portion of the population faces additional hurdles. As noted by the China National Tourism Administration, government policies significantly influence travel patterns and behaviors. In contrast, easing these restrictions could stimulate growth in outbound tourism, aligning with broader economic goals to boost consumption and international engagement.

Chinese domestic policy restricts outbound travel for government employees, affecting overall tourism statistics and travel patterns.

Chinese domestic policy restricts outbound travel for government employees, affecting overall tourism statistics and travel patterns.

4. What Is The Forecast For China’s Outbound Tourism In The Coming Years?

China’s outbound tourism is expected to continue its recovery in 2024, with acceleration in travel outside of Greater China. However, the overall number of Chinese outbound travelers is projected to remain below pre-pandemic levels until 2025. Nominal tourism expenditure is expected to recover more quickly than tourist volumes, supported by higher prices in most destinations and the tendency for early overseas travelers to be from higher-income groups who are less sensitive to prices.

According to forecasts from the Economist Intelligence Unit (EIU), the stabilization of the renminbi exchange rate and easing inflation in major tourism destinations will support outbound tourism demand in 2024. Improving labor market conditions are also likely to restore household income expectations and consumer confidence, leading to increased spending on overseas travel. However, structural challenges in the labor market, such as youth unemployment, will continue to pose challenges, as young people make up a significant portion of outbound travelers. Flight capacity is expected to increase to near pre-pandemic levels, further boosting outbound tourism demand. Chinese officials have set a target of achieving 80% of pre-pandemic weekly flight capacity by the end of 2024. Normalized flight routes from China are likely to concentrate in the Asia Pacific and the Middle East, with routes to the Americas recovering more slowly. Visa-free agreements are expected to extend flight capacity and benefit bilateral tourism volume.

5. How Are Chinese Tourists’ Travel Preferences Changing?

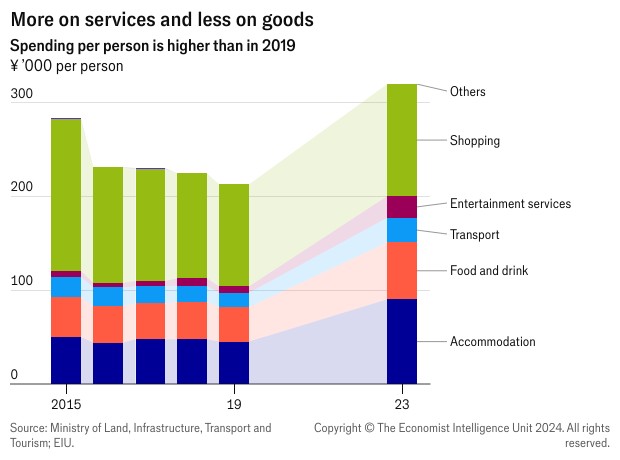

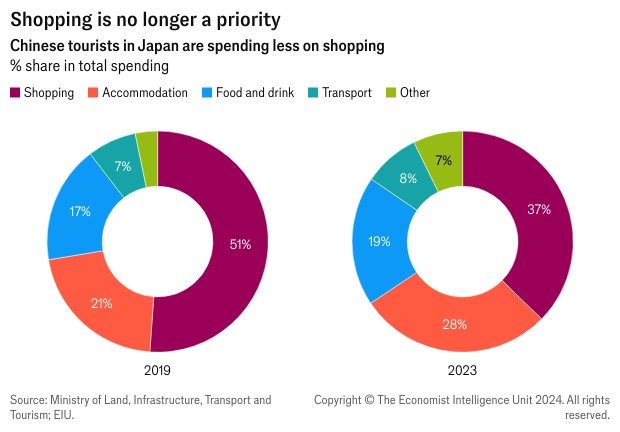

Chinese tourists’ travel preferences are evolving, with a gradual shift from shopping overseas to consuming cultural and experiential products. The share of shopping in Chinese tourists’ total spending in Japan, for example, dropped from 51.1% in 2019 to 37.3% in 2023, while spending on accommodation and entertainment surged.

This trend suggests increasing interest in sports and musical events that drive overseas travel. As household incomes rise and people are more willing to spend, the share of tourism in total household expenditure is expected to increase, benefiting the growth in outbound tourism. Despite near-term obstacles, China’s outbound tourism remains on a growth trajectory in the long run.

According to a study by McKinsey & Company, Chinese consumers are increasingly prioritizing experiences and unique travel opportunities. A low share of valid passport holders also indicates a largely untapped consumer base. Currently, about 14% of Chinese adults own a valid passport (data from 2019), compared with 56% in the US and 84% in the UK.

Chinese tourism statistics reflect evolving travel preferences, emphasizing cultural experiences over shopping.

Chinese tourism statistics reflect evolving travel preferences, emphasizing cultural experiences over shopping.

6. What Impact Does Exchange Rate Have On Outbound Tourism?

Exchange rates significantly impact outbound tourism. A weaker renminbi (RMB) makes international travel more expensive for Chinese tourists, reducing their purchasing power in foreign destinations. This can lead to a decrease in outbound travel as the cost of flights, accommodation, and other travel-related expenses increases. According to the People’s Bank of China, fluctuations in the RMB exchange rate directly influence the affordability of overseas travel.

Conversely, a stronger RMB makes international travel more affordable, potentially boosting outbound tourism. The exchange rate also affects the competitiveness of destinations. Countries with currencies weaker than the RMB may become more attractive to Chinese tourists seeking value for their money. According to data from the State Administration of Foreign Exchange, stable or strengthening RMB conditions generally correlate with increased outbound tourism.

7. How Does Flight Capacity Influence China Outbound Tourism Statistics?

Flight capacity plays a crucial role in China’s outbound tourism. Increased flight availability directly supports outbound tourism demand by providing more options for travelers, making it easier and potentially cheaper to travel internationally. Chinese officials have aimed to restore weekly flight capacity to 80% of pre-pandemic levels by the end of 2024, signaling a commitment to boosting outbound travel.

Airlines adjust flight routes based on demand and bilateral agreements, concentrating normalized flight routes from China in the Asia Pacific and the Middle East, while routes to the Americas recover more slowly. Visa-free agreements can extend flight capacity by making destinations more attractive and reducing barriers to travel. According to the Civil Aviation Administration of China, expanding flight capacity and optimizing flight routes are key strategies for promoting outbound tourism.

Outbound tourism trends are shaped by flight capacity increases, with China focusing on Asia Pacific and Middle East routes.

Outbound tourism trends are shaped by flight capacity increases, with China focusing on Asia Pacific and Middle East routes.

8. What Role Do Visa Policies Play In Shaping China Outbound Tourism?

Visa policies are pivotal in shaping China’s outbound tourism. Simplified visa processes or visa waivers can significantly boost Chinese visitor arrivals by reducing the complexity and uncertainty associated with travel planning. Singapore’s example, where Chinese tourist numbers increased significantly after a visa waiver, highlights the impact of visa policies. Countries with visa-free entry agreements with China, such as Thailand, Singapore, Malaysia, and the UAE, are expected to see increased Chinese arrivals.

Conversely, complex or restrictive visa processes can deter potential travelers, leading to a decrease in outbound tourism. Geopolitical tensions can also exacerbate visa application challenges, creating additional hurdles for Chinese tourists. According to the Ministry of Foreign Affairs of China, visa facilitation is an important factor in promoting international tourism and people-to-people exchanges.

9. How Does Consumer Confidence Affect China Outbound Tourism Statistics?

Consumer confidence significantly impacts China’s outbound tourism. Higher consumer confidence typically leads to increased willingness to spend on discretionary items such as overseas travel. Improving labor market conditions and positive economic forecasts can boost consumer confidence, encouraging more Chinese residents to plan and book international trips. The National Bureau of Statistics of China regularly tracks consumer confidence indices, which serve as indicators of potential travel trends.

Conversely, low consumer confidence due to economic uncertainty or concerns about personal finances can lead to decreased spending on outbound tourism. Structural problems in the labor market, such as youth unemployment, can disproportionately affect travel spending, as young people make up a significant portion of outbound travelers. According to a report by China Daily, consumer sentiment directly influences travel decisions and spending patterns.

10. What Travel Services Does SIXT.VN Offer To International Tourists?

SIXT.VN offers a range of services designed to make your travel to Vietnam seamless and enjoyable:

- Tourism Advisory Services: Personalized travel advice tailored to your interests and preferences.

- Airport Transfers: Convenient and reliable airport pick-up and drop-off services.

- Hotel Booking: Assistance with finding and booking the best accommodations to suit your budget and needs.

- Sightseeing Tours: Guided tours to explore the famous sights and hidden gems of Hanoi and surrounding areas.

- Flight Arrangements: Support with booking flights at competitive prices and convenient schedules.

Tourist spending habits evolve from shopping to cultural experiences, affecting global market strategies.

Tourist spending habits evolve from shopping to cultural experiences, affecting global market strategies.

Planning a trip to Vietnam? Let SIXT.VN handle the details. From airport transfers to hotel bookings and guided tours, we ensure a smooth and unforgettable experience. Contact us today!

Address: 260 Cau Giay, Hanoi, Vietnam

Hotline/Whatsapp: +84 986 244 358

Website: SIXT.VN