Are credit card surcharges common, especially when traveling? Yes, credit card surcharges are becoming increasingly common, but understanding the nuances is crucial for international travelers, especially in destinations like Vietnam. SIXT.VN offers streamlined travel solutions, ensuring you’re never caught off guard by unexpected fees. Navigating these charges effectively can significantly impact your travel budget and overall experience. With careful planning and the right information, you can enjoy your travels without the stress of hidden costs, ensuring a smooth and enjoyable journey.

1. Understanding Credit Card Surcharges

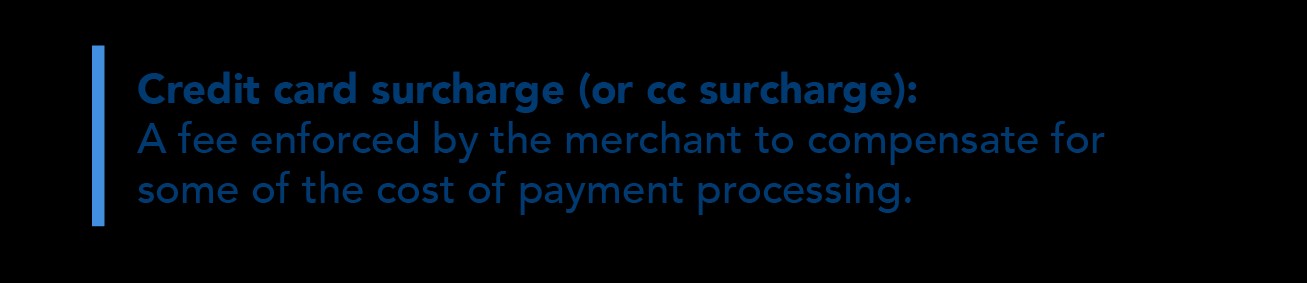

What exactly is a credit card surcharge? A credit card surcharge is a fee that merchants add to your bill when you pay with a credit card. This fee is designed to offset the processing fees that merchants incur from credit card companies. These fees are commonly percentage-based, adding a small percentage to your total purchase. Knowing about these surcharges helps travelers manage their expenses effectively and make informed payment decisions.

- Processing Fees Explained: When a business processes a credit card transaction, financial institutions charge a fee. A credit card surcharge compensates for part of this fee, applying only to credit cards, not debit cards.

- Percentage-Based Calculation: Surcharges are generally calculated as a percentage of the total transaction amount. For example, a 2% surcharge on a $100 purchase would add $2 to the bill.

Credit Card Payment

Credit Card Payment

2. Legality of Credit Card Surcharges: A Global Perspective

Are credit card surcharges legal worldwide? Credit card surcharges’ legality varies by region. In the U.S., most states allow them, but some have restrictions. Europe generally prohibits them, while in other parts of the world, like Vietnam, the practice is less regulated but becoming more common. Understanding the legal landscape helps travelers anticipate and manage potential charges. SIXT.VN ensures you’re informed about local payment practices, making your travel smoother.

- United States: While largely outlawed for decades, a class action lawsuit in 2013 permitted merchants in many U.S. states to implement surcharges. The legal landscape continues to evolve.

- Europe: Many European countries prohibit credit card surcharges to protect consumers. This regulation ensures that customers are not penalized for choosing to pay with a credit card.

- Vietnam: The legal situation in Vietnam is less strict. While not explicitly regulated, surcharges are becoming more prevalent, especially in tourist areas.

3. Credit Card Surcharge Laws by Region

Where are credit card surcharges legal, and where are they not? Credit card surcharge legality differs significantly across the globe. In the U.S., most states permit them with certain restrictions, while others still have anti-surcharging laws, though some may not be fully enforceable. Europe generally prohibits these fees to protect consumers. Meanwhile, in countries like Vietnam, the practice is less regulated but growing. Knowing these regional differences helps travelers avoid surprises.

- United States:

- Legal: Most states allow surcharges with certain restrictions.

- Restrictions: Some states limit the surcharge amount or require specific disclosures.

- Enforceability: Anti-surcharging laws in some states may not be fully enforceable due to court decisions.

- Europe:

- Prohibited: Most European countries prohibit credit card surcharges.

- Consumer Protection: This ban aims to protect consumers from additional fees.

- Vietnam:

- Less Regulated: Surcharges are becoming more common, especially in tourist areas.

- Transparency: Lack of strict regulation means transparency can vary; always check before paying.

4. Credit Card Surcharging Rules: What to Know

What are the rules for credit card surcharges? Major credit card institutions like Visa and Mastercard have specific rules for merchants implementing surcharges. These include notifying the card institution and clients, not surcharging more than the processing fee, not applying surcharges to debit card transactions, listing surcharges as separate line items, and staying PCI compliant. SIXT.VN ensures you’re informed about these rules, helping you navigate payments confidently during your travels.

- Notify Credit Card Institution: Merchants must inform major credit card institutions in writing about their intent to surcharge.

- Notify Clients: Clients must be clearly informed about the surcharge, either on the invoice or through a displayed sign.

- Surcharge Limit: The surcharge should not exceed the actual cost of the processing fee, generally capped at 3% in the U.S.

- No Debit Card Surcharges: Surcharges are strictly limited to credit card transactions. Debit card transactions, even when processed as credit, are exempt.

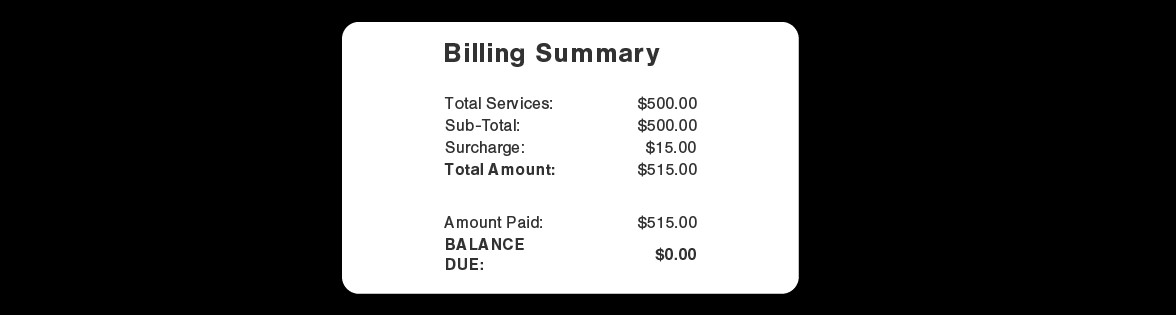

- Separate Line Items: Surcharges must be listed separately on the invoice, ensuring transparency and easy tracking.

- PCI Compliance: Businesses must comply with Payment Card Industry Data Security Standards (PCI DSS) to protect credit card information.

Separate Line Items

Separate Line Items

5. How to Handle Credit Card Surcharges as a Traveler

How can travelers effectively handle credit card surcharges? To manage credit card surcharges while traveling, understand the local laws and regulations, ask about potential fees before making a purchase, consider using alternative payment methods like cash or debit cards where surcharges are not applied, and choose credit cards that offer rewards or benefits to offset the costs. Being proactive and informed can help minimize unexpected expenses.

- Understand Local Laws: Research credit card surcharge laws in your destination country or region.

- Ask About Fees: Inquire about potential surcharges before making a purchase or using a service.

- Use Alternative Payment Methods: Consider using cash or debit cards where surcharges are not applicable.

- Choose the Right Credit Card: Opt for credit cards that offer rewards or benefits to offset potential surcharge costs.

- SIXT.VN Tip: With SIXT.VN, you’ll receive transparent pricing, helping you avoid unexpected surcharge surprises and manage your travel budget effectively.

6. Credit Card Surcharges in Vietnam: What to Expect

What should travelers expect regarding credit card surcharges in Vietnam? In Vietnam, credit card surcharges are becoming more common, especially in tourist areas. While not strictly regulated, merchants may add a fee for credit card payments. Travelers should inquire about these fees before making a purchase and be prepared to use alternative payment methods like cash or local payment apps to avoid extra charges. SIXT.VN ensures transparency in its services, helping you avoid hidden costs.

- Growing Prevalence: Surcharges are becoming more common, especially in tourist hotspots.

- Lack of Regulation: Vietnam lacks strict regulations on surcharges, making transparency crucial.

- Inquire Before Paying: Always ask about potential surcharges before making a purchase.

- Alternative Payment Methods: Consider using cash or local payment apps to avoid extra charges.

7. Credit Card Surcharges vs. Cash Discounts

What’s the difference between credit card surcharges and cash discounts? Credit card surcharges are fees added to the bill when using a credit card, while cash discounts offer a lower price for paying with cash. Surcharges offset processing fees for the merchant, while cash discounts incentivize customers to use cash, reducing the merchant’s processing costs. Understanding this difference helps travelers choose the most cost-effective payment method.

- Credit Card Surcharge: A fee added when paying with a credit card to offset processing fees.

- Cash Discount: A reduced price offered for paying with cash.

- Merchant Benefit: Surcharges help merchants cover processing costs; cash discounts reduce these costs by encouraging cash payments.

- Traveler Choice: Knowing the difference allows travelers to choose the most economical payment option based on the specific situation.

8. Alternatives to Paying with Credit Cards to Avoid Surcharges

What are some alternatives to using credit cards to avoid surcharges? To avoid credit card surcharges, travelers can use cash, debit cards (where surcharges are not applied), prepaid travel cards, or local payment apps. Each option has its pros and cons, so it’s essential to weigh the convenience, security, and potential fees associated with each. SIXT.VN provides various payment options to suit your needs, ensuring a hassle-free experience.

- Cash: Widely accepted and avoids surcharges, but can be inconvenient for large transactions.

- Debit Cards: Often do not incur surcharges, but check for transaction fees.

- Prepaid Travel Cards: Allow budgeting and avoid overspending, but may have activation and usage fees.

- Local Payment Apps: Convenient and may offer better exchange rates, but require setup and familiarity.

- SIXT.VN Flexibility: SIXT.VN offers diverse payment options, allowing you to choose the most convenient and cost-effective method.

9. The Impact of Credit Card Surcharges on Travel Budgets

How do credit card surcharges impact your travel budget? Credit card surcharges can significantly impact a travel budget, especially if not anticipated. These small fees can accumulate over multiple transactions, leading to unexpected expenses. Travelers should factor in potential surcharges when planning their budget and consider alternative payment methods to minimize these costs. SIXT.VN helps you manage your budget by providing clear and upfront pricing.

- Accumulation of Fees: Small surcharges can add up, impacting your overall budget.

- Unexpected Expenses: Lack of awareness can lead to unplanned costs.

- Budget Planning: Factor in potential surcharges when creating your travel budget.

- Alternative Methods: Consider cash or debit cards to minimize surcharge costs.

- SIXT.VN Transparency: SIXT.VN offers transparent pricing, helping you avoid unexpected surcharge surprises and manage your travel budget effectively.

10. Staying Informed: Resources for Travelers on Credit Card Surcharges

Where can travelers find reliable information on credit card surcharges? Travelers can stay informed about credit card surcharges by checking official government websites, credit card company policies, travel forums, and reputable travel blogs. These resources offer valuable insights into the legality, prevalence, and best practices for managing surcharges in different regions. SIXT.VN keeps you updated with relevant information, ensuring a smooth travel experience.

- Government Websites: Provide legal information on surcharges in different regions.

- Credit Card Company Policies: Detail surcharge policies and potential fees.

- Travel Forums: Offer real-world experiences and tips from fellow travelers.

- Reputable Travel Blogs: Provide insights on surcharge prevalence and best practices.

- SIXT.VN Updates: SIXT.VN keeps you informed with relevant information, ensuring a smooth and surcharge-savvy travel experience.

11. Ethical Considerations for Merchants Charging Credit Card Surcharges

Are there ethical considerations for merchants when charging credit card surcharges? Yes, ethical considerations are crucial for merchants charging credit card surcharges. Transparency is key: merchants should clearly disclose the surcharge before the transaction. The fee should accurately reflect the processing cost, avoiding profit-making. Additionally, offering alternative payment methods without surcharges ensures fair options for customers. These practices build trust and maintain positive relationships.

- Transparency: Clearly disclose the surcharge before the transaction to avoid surprises.

- Accurate Reflection: The surcharge should accurately reflect the processing cost, not a profit-making venture.

- Alternative Options: Offer alternative payment methods without surcharges to provide fair options for customers.

- Customer Trust: Ethical practices build trust and maintain positive customer relationships.

12. Future Trends in Credit Card Surcharges

What are the future trends in credit card surcharges? Credit card surcharges are expected to become more common as merchants seek to offset rising processing fees. Increased transparency and standardization may emerge to protect consumers. Technological advancements could also offer alternative payment solutions with lower fees. Staying informed about these trends helps travelers prepare for future changes.

- Increased Prevalence: Surcharges are likely to become more common due to rising processing fees.

- Transparency and Standardization: Greater efforts may be made to ensure clear disclosure and consistent application of surcharges.

- Technological Advancements: New payment technologies could offer lower-fee alternatives.

- Traveler Preparedness: Staying informed helps travelers adapt to future changes in surcharge practices.

13. How SIXT.VN Can Help You Navigate Credit Card Surcharges in Vietnam

How can SIXT.VN help you navigate credit card surcharges in Vietnam? SIXT.VN offers clear and upfront pricing, ensuring you’re aware of all costs before booking. We provide various payment options, allowing you to choose the most convenient and cost-effective method. Our local expertise keeps you informed about payment practices in Vietnam, helping you avoid unexpected fees. With SIXT.VN, you can enjoy a transparent and hassle-free travel experience.

- Clear and Upfront Pricing: SIXT.VN ensures you know all costs before booking.

- Diverse Payment Options: Choose the most convenient and cost-effective payment method.

- Local Expertise: Stay informed about payment practices in Vietnam.

- Transparent Experience: Enjoy a hassle-free travel experience with SIXT.VN.

Planning a trip to Vietnam? Navigating credit card surcharges can be tricky, but with SIXT.VN, you’re in good hands.

- Airport Transfers: Start your trip stress-free with our reliable and transparent airport transfer services.

- Hotel Bookings: Find the perfect accommodation with clear pricing and no hidden fees.

- Tours: Explore Hanoi and beyond with our expertly curated tours, ensuring you know all costs upfront.

- Flight Bookings: Get the best deals on flights with transparent pricing and no unexpected surcharges.

Contact us today to plan your perfect Vietnamese getaway.

Address: 260 Cau Giay, Hanoi, Vietnam

Hotline/Whatsapp: +84 986 244 358

Website: SIXT.VN

14. Practical Tips for Minimizing Credit Card Surcharges While Traveling

What are some practical tips for minimizing credit card surcharges while traveling? Minimize credit card surcharges by using cash for small purchases, opting for debit cards where surcharges don’t apply, and researching local payment customs. Use travel cards with low foreign transaction fees, and always inquire about surcharges before paying. Being proactive helps manage travel expenses effectively.

- Use Cash for Small Purchases: Avoid surcharges on smaller transactions by paying with cash.

- Opt for Debit Cards: Debit cards often don’t incur surcharges; verify with your bank.

- Research Local Customs: Understand payment norms in your destination.

- Travel Cards with Low Fees: Use cards designed for travel with minimal foreign transaction fees.

- Inquire Before Paying: Always ask about potential surcharges before making a purchase.

15. Credit Card Surcharges and the Future of Travel Payments

How do credit card surcharges fit into the future of travel payments? As digital payments evolve, credit card surcharges may become more standardized or replaced by new fee structures. Contactless payments and mobile wallets may offer lower-fee alternatives. Travelers who stay informed and adapt to these changes can optimize their payment strategies and minimize costs.

- Standardization: Surcharges may become more standardized to protect consumers.

- New Fee Structures: Alternative fee models may emerge in the digital payment landscape.

- Contactless and Mobile Payments: These options may offer lower fees.

- Adaptability: Staying informed allows travelers to optimize payment strategies.

16. How to Complain About Unfair Credit Card Surcharges

How can you complain about unfair credit card surcharges? To complain about unfair credit card surcharges, start by discussing the issue with the merchant, providing clear documentation. If unresolved, contact your credit card company to dispute the charge, and file a complaint with consumer protection agencies. Document everything and persist until the issue is resolved.

- Discuss with Merchant: Start by addressing the surcharge with the merchant.

- Contact Credit Card Company: Dispute the charge with your credit card provider.

- File Complaint: Contact consumer protection agencies to report the issue.

- Document Everything: Keep records of all communications and transactions.

17. The Role of Technology in Managing Credit Card Surcharges

How does technology help in managing credit card surcharges? Technology plays a crucial role in managing credit card surcharges through mobile payment apps that offer lower fees, digital wallets that consolidate payment options, and travel budgeting apps that track expenses. By leveraging these tools, travelers can make informed payment decisions and minimize costs.

- Mobile Payment Apps: Offer lower transaction fees compared to traditional credit cards.

- Digital Wallets: Consolidate payment options for easy access and management.

- Travel Budgeting Apps: Track expenses and provide insights into surcharge costs.

- Informed Decisions: Technology enables informed payment decisions and cost minimization.

18. Understanding Currency Conversion Fees Alongside Credit Card Surcharges

How do currency conversion fees relate to credit card surcharges? Currency conversion fees and credit card surcharges are distinct but can both increase the cost of transactions. Currency conversion fees apply when you use your card in a foreign currency, while surcharges are added by the merchant. Awareness of both helps travelers avoid unexpected costs.

- Distinct Fees: Currency conversion fees and surcharges are separate charges.

- Currency Conversion: Applies when using your card in a foreign currency.

- Surcharge: Added by the merchant to offset processing costs.

- Cost Awareness: Understanding both helps avoid unexpected expenses.

19. The Impact of Credit Card Surcharges on Small Businesses and Tourism

How do credit card surcharges impact small businesses and tourism? Credit card surcharges can significantly affect small businesses by potentially deterring customers. In the tourism sector, unexpected surcharges can lead to negative experiences, affecting a destination’s reputation. Transparency and fair practices are essential for maintaining customer satisfaction and fostering economic growth.

- Impact on Small Businesses: Surcharges may deter customers from making purchases.

- Tourism Sector: Unexpected fees can lead to negative tourist experiences.

- Transparency: Clear disclosure of surcharges is crucial for customer satisfaction.

- Economic Growth: Fair practices foster positive reputations and support economic growth.

20. Navigating Credit Card Surcharges in Different Asian Countries

What are the specific considerations for credit card surcharges in different Asian countries? Credit card surcharge practices vary widely across Asian countries. In some countries, surcharges are common, while others prohibit them. Travelers should research local customs and regulations, use cash when necessary, and opt for cards with low foreign transaction fees to minimize costs.

- Varying Practices: Surcharge practices differ significantly across Asian countries.

- Local Research: Understand local customs and regulations before traveling.

- Cash Usage: Use cash in countries where surcharges are prevalent.

- Low Transaction Fees: Choose cards with minimal foreign transaction fees.

21. The Psychology Behind Credit Card Surcharges and Consumer Behavior

How do credit card surcharges influence consumer behavior from a psychological perspective? Credit card surcharges can trigger negative psychological responses, such as feelings of unfairness or being exploited. This can lead to decreased customer satisfaction and loyalty. Merchants should implement transparent and justified surcharge policies to mitigate these negative effects.

- Negative Responses: Surcharges can evoke feelings of unfairness or exploitation.

- Customer Satisfaction: Negative perceptions can decrease satisfaction and loyalty.

- Transparent Policies: Clear and justified surcharge policies are essential.

- Mitigation: Transparency helps mitigate negative psychological effects.

22. Strategies for Negotiating Credit Card Surcharges with Merchants

What strategies can travelers use to negotiate credit card surcharges with merchants? When faced with a credit card surcharge, travelers can politely inquire if there’s a discount for cash payment, ask if the surcharge can be waived, or consider taking their business elsewhere. Remaining calm and informed can lead to a favorable outcome.

- Cash Discount Inquiry: Ask if there’s a discount for paying with cash.

- Waiver Request: Politely request if the surcharge can be waived.

- Alternative Options: Consider taking your business to a merchant without surcharges.

- Calm Demeanor: Remain calm and informed during negotiations.

23. Credit Card Surcharges and Online Travel Bookings

How do credit card surcharges apply to online travel bookings? Credit card surcharges in online travel bookings can be tricky. They are often disclosed late in the booking process. Always review the final price before confirming, check for alternative payment options, and use travel websites that offer transparent pricing to avoid surprises.

- Late Disclosure: Surcharges are often revealed late in the booking process.

- Final Price Review: Always check the final price before confirming your booking.

- Alternative Options: Look for alternative payment options to avoid surcharges.

- Transparent Websites: Use travel websites that offer clear pricing.

24. The Role of Consumer Advocacy Groups in Regulating Credit Card Surcharges

How do consumer advocacy groups play a role in regulating credit card surcharges? Consumer advocacy groups play a crucial role in advocating for fair credit card surcharge policies. They push for transparency, challenge unfair practices, and educate consumers about their rights. Supporting these groups helps ensure a fair and equitable marketplace.

- Advocacy for Fair Policies: Consumer groups push for fair surcharge practices.

- Transparency Promotion: They advocate for clear surcharge disclosure.

- Challenging Unfair Practices: They challenge unfair or deceptive surcharge policies.

- Consumer Education: They educate consumers about their rights and how to avoid unfair fees.

25. Credit Card Surcharges and the Sharing Economy (e.g., Airbnb, Uber)

How do credit card surcharges apply to the sharing economy, such as Airbnb and Uber? In the sharing economy, credit card surcharges are often included in the service fee but may not always be transparent. Review the total cost before confirming, understand the platform’s payment policies, and consider using payment methods linked directly to your bank account to avoid extra fees.

- Inclusion in Service Fees: Surcharges are often included in the overall service fee.

- Total Cost Review: Always review the total cost before confirming your booking or ride.

- Platform Policies: Understand the payment policies of the sharing economy platform.

- Direct Bank Links: Consider payment methods linked directly to your bank account.

26. Long-Term Strategies for Reducing Reliance on Credit Cards to Avoid Surcharges

What are some long-term strategies for reducing reliance on credit cards to avoid surcharges? Long-term strategies include budgeting and saving to use cash, exploring debit cards with rewards, and using alternative payment systems with lower fees. Building financial habits that reduce credit card dependency can save money and avoid surcharges.

- Budgeting and Saving: Plan your expenses and save to use cash for purchases.

- Debit Cards with Rewards: Explore debit cards that offer rewards or cashback.

- Alternative Payment Systems: Use payment systems with lower fees than credit cards.

- Financial Habits: Build habits that reduce dependency on credit cards.

27. Case Studies of Countries with Successful Credit Card Surcharge Regulations

What countries have successfully regulated credit card surcharges? Countries like Australia and the UK have successfully regulated credit card surcharges by mandating transparency and capping surcharge amounts. These regulations protect consumers and ensure fair practices. Studying these models can inform other countries seeking to regulate surcharges effectively.

- Australia: Mandates transparency and caps surcharge amounts.

- United Kingdom: Implements regulations to protect consumers from excessive fees.

- Consumer Protection: Regulations ensure fair and equitable practices.

- Effective Models: These countries provide models for effective surcharge regulation.

28. Credit Card Surcharges and Loyalty Programs: Are They Compatible?

How do credit card surcharges interact with loyalty programs? Credit card surcharges can undermine the value of loyalty programs if the added fees outweigh the rewards earned. Choose cards with strong rewards programs and low or no surcharges, and consider alternative payment methods to maximize the benefits of loyalty programs.

- Undermining Value: Surcharges can reduce the value of loyalty rewards.

- Card Selection: Choose cards with strong rewards and low surcharges.

- Alternative Methods: Use alternative payment methods to maximize rewards.

- Maximize Benefits: Balance surcharges and rewards to optimize loyalty program benefits.

29. The Impact of COVID-19 on Credit Card Surcharges and Payment Trends

How has COVID-19 impacted credit card surcharges and payment trends? The COVID-19 pandemic accelerated the shift towards contactless and digital payments, potentially increasing the use of credit cards and, consequently, surcharges. Additionally, some businesses may have introduced or increased surcharges to offset pandemic-related costs.

- Shift to Digital Payments: Accelerated adoption of contactless and digital payments.

- Increased Credit Card Use: Greater reliance on credit cards for online and in-person transactions.

- Pandemic-Related Costs: Some businesses introduced or increased surcharges to offset costs.

- Payment Trends: The pandemic has reshaped payment trends and surcharge practices.

30. Future-Proofing Your Travel Budget Against Credit Card Surcharges

How can you future-proof your travel budget against credit card surcharges? To future-proof your travel budget, stay informed about global payment trends, diversify your payment methods, and leverage technology to track and minimize expenses. Building a flexible budget and adapting to new payment options will help you manage surcharges effectively.

- Stay Informed: Keep up-to-date with global payment trends and surcharge practices.

- Diversify Payment Methods: Use a mix of cash, debit cards, and alternative payment systems.

- Leverage Technology: Use budgeting apps to track and minimize expenses.

- Flexible Budget: Create a budget that accounts for potential surcharges.

Are you ready to explore Vietnam without worrying about hidden fees? SIXT.VN is here to make your travel experience seamless and transparent. Contact us today to start planning your adventure. With SIXT.VN, you’re not just booking a trip; you’re investing in peace of mind.

FAQ: Credit Card Surcharges

- What is a credit card surcharge?

A credit card surcharge is a fee added to your bill when you pay with a credit card, designed to offset the processing fees that merchants incur. - Are credit card surcharges legal?

The legality of credit card surcharges varies by region. In the U.S., most states allow them with restrictions, while Europe generally prohibits them. - How can I avoid credit card surcharges?

You can avoid surcharges by using cash, debit cards (where surcharges don’t apply), or local payment apps. - What should I expect regarding credit card surcharges in Vietnam?

In Vietnam, surcharges are becoming more common, especially in tourist areas. Always inquire before paying and consider alternative payment methods. - What is the difference between a credit card surcharge and a cash discount?

A surcharge is a fee added for using a credit card, while a cash discount offers a lower price for paying with cash. - How do credit card surcharges impact my travel budget?

Surcharges can accumulate and lead to unexpected expenses, so factor them into your budget and consider alternative payment methods. - Where can I find reliable information on credit card surcharges?

Check official government websites, credit card company policies, travel forums, and reputable travel blogs. - Are there ethical considerations for merchants charging credit card surcharges?

Yes, transparency is key. Merchants should clearly disclose the surcharge before the transaction and offer alternative payment methods. - How can SIXT.VN help me navigate credit card surcharges in Vietnam?

SIXT.VN offers clear pricing, diverse payment options, and local expertise to help you avoid unexpected fees. - What are some long-term strategies for reducing reliance on credit cards to avoid surcharges?

Strategies include budgeting and saving to use cash, exploring debit cards with rewards, and using alternative payment systems with lower fees.