Are you wondering How Much To Charge Per Mile For Travel in Vietnam? SIXT.VN offers clear guidance on calculating travel costs, ensuring fair and profitable rates for your services. Optimize your travel expenses with smart strategies and discover the best ways to enhance your Vietnam travel experience.

1. What Factors Determine How Much to Charge Per Mile for Travel?

Determining how much to charge per mile for travel depends on several key factors, ensuring you cover costs and make a profit. These include understanding your operating expenses, industry standards, and customer expectations. SIXT.VN helps you navigate these considerations for efficient travel planning and costing.

-

Vehicle Expenses: The type of vehicle you use significantly impacts your costs. Larger vehicles or those carrying heavy equipment consume more fuel, increasing your expenses per mile. According to the U.S. Energy Information Administration, fuel costs can fluctuate, affecting your overall mileage rate calculations.

-

Industry Standards: Different industries have varying standards for mileage rates. Researching what others in your sector charge can provide a benchmark. Associations like the American Trucking Associations (ATA) offer data on transportation costs.

-

Service Type: The specific service you provide influences how you price your mileage. Premium or specialized services might justify higher rates.

-

Geographic Location: Operating in congested urban areas versus rural settings affects travel time and fuel consumption. High-traffic areas might warrant a higher per-mile charge to compensate for delays.

-

Customer Base: Understanding your customer’s willingness to pay is crucial. Conduct market research to determine a rate that is both acceptable to your clients and profitable for your business.

-

Maintenance Costs: Regular vehicle maintenance, including oil changes, tire replacements, and repairs, should be factored into your per-mile rate.

-

Insurance and Depreciation: These costs contribute to the overall expense of operating a vehicle and should be considered when setting your rates.

Charging an appropriate per-mile rate ensures you cover all associated costs while remaining competitive and profitable.

2. What Are the Standard Methods for Calculating Mileage Charges for Clients in Vietnam?

When calculating mileage charges for clients in Vietnam, several standard methods can be applied to ensure fair and transparent billing. These methods take into account factors like distance traveled, time spent, and specific business needs. SIXT.VN offers solutions to help businesses accurately track and calculate these charges, making billing straightforward and efficient.

-

Per-Mile Rate: This is the most common method, where clients are charged a set rate for each mile driven. The rate should cover fuel, maintenance, and vehicle depreciation. The current 2025 IRS mileage rate is $0.70 per business mile.

-

Flat Distance Rate: A flat rate is charged for travel within a specific distance range. For example, the first 20 miles might be free, with a set fee for each additional 20 miles.

-

Hourly Rate: Useful for congested areas where travel time is unpredictable, this method charges clients based on the time spent driving. The hour can be divided into 15-minute increments for more precise billing.

-

Hybrid Approach: Combining a flat rate with additional charges for time spent in traffic can provide a balanced approach. This ensures that both distance and time are compensated.

-

Tiered System: A tiered system offers different rates based on distance ranges, providing flexibility and fairness for varying travel needs.

-

Fuel Cost Plus Mileage: Clients are charged for the actual cost of fuel used, plus a standard per-mile rate to cover other expenses.

-

Negotiated Rate: For regular clients or large projects, negotiating a custom rate can be beneficial for both parties.

Using these methods helps ensure that mileage charges are fair, transparent, and cover all associated costs.

3. How Does SIXT.VN Help With Calculating Travel Mileage in Vietnam?

SIXT.VN offers comprehensive solutions for calculating travel mileage in Vietnam, ensuring accuracy and convenience for both businesses and travelers. By leveraging SIXT.VN’s services, you can streamline mileage tracking, optimize travel expenses, and focus on delivering exceptional service. According to a report by the Vietnam National Administration of Tourism, efficient transport solutions are key to enhancing tourist experiences in Vietnam.

-

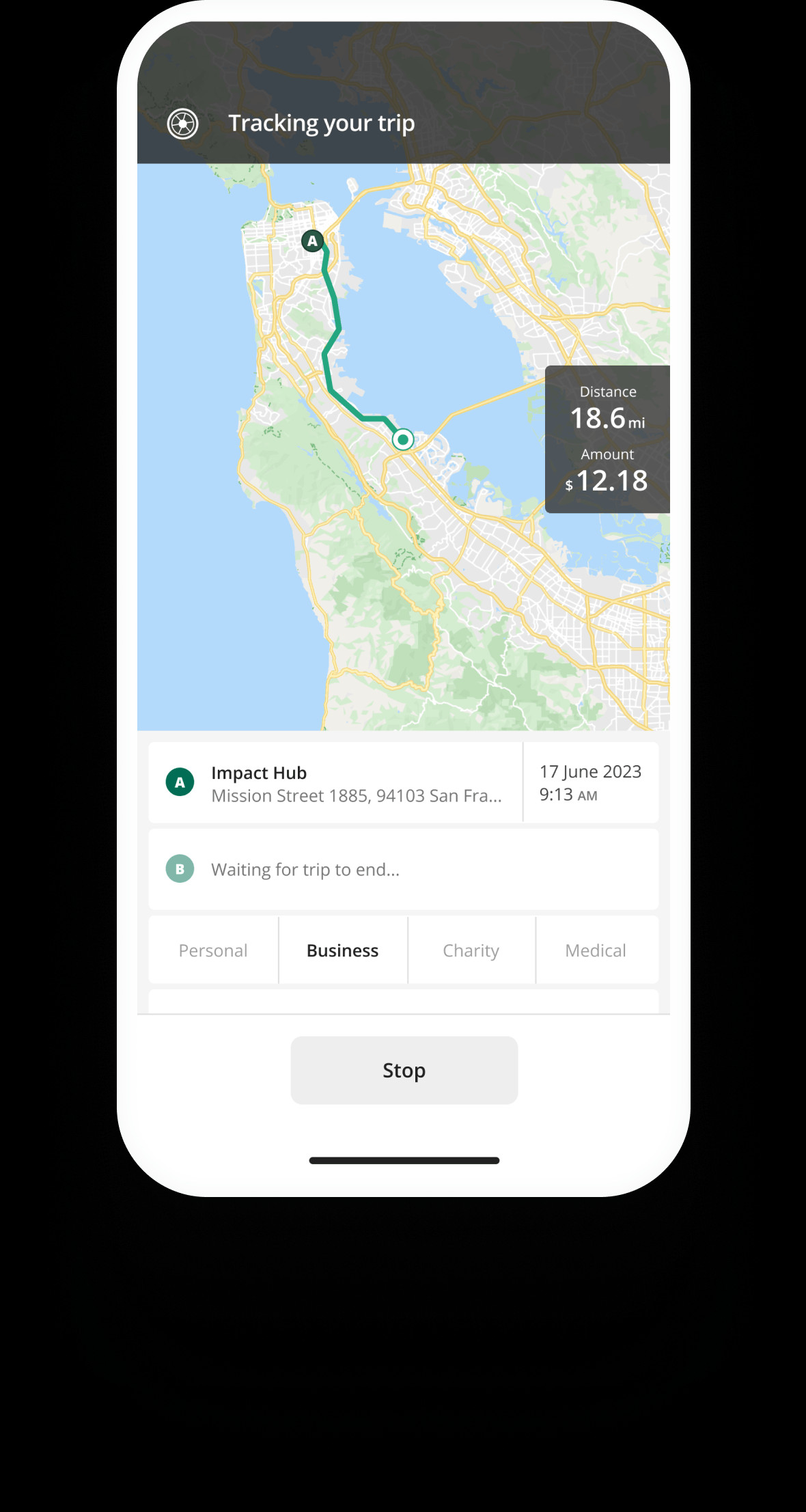

Automated Mileage Tracking: SIXT.VN’s platform automatically tracks mileage, eliminating manual logging and reducing errors.

-

Real-Time Data: Access real-time data on distances traveled, allowing for immediate and accurate billing.

-

Customizable Rates: Set custom mileage rates based on vehicle type, service, and location, ensuring fair and profitable pricing.

-

Integrated Billing: SIXT.VN integrates with billing systems, simplifying the invoicing process and ensuring prompt payment.

-

Expense Management: Track and manage all travel-related expenses, including fuel, maintenance, and tolls, in one centralized location.

-

Route Optimization: Plan the most efficient routes to minimize mileage and reduce travel time, saving both time and money.

-

Reporting and Analytics: Generate detailed reports on mileage, expenses, and travel patterns, providing valuable insights for business planning.

-

Mobile Accessibility: Use SIXT.VN’s mobile app to track mileage on the go, ensuring accurate data capture no matter where you are.

-

Compliance: Ensure compliance with local tax regulations by accurately tracking and reporting mileage for business purposes.

-

Customer Support: Access dedicated customer support to assist with any questions or issues related to mileage tracking and calculations.

4. What Is the IRS Standard Mileage Rate and How Does It Apply to Travel?

The IRS standard mileage rate is a benchmark used to calculate the deductible costs of operating a vehicle for business, medical, or moving purposes. This rate simplifies expense tracking and provides a consistent measure for taxpayers. SIXT.VN helps you understand and apply this rate effectively to optimize your travel-related deductions.

-

Business Use: The business mileage rate is used to calculate the deductible expenses for using a vehicle for business purposes. This includes travel to meet clients, attend conferences, or run errands. As of 2025, the IRS standard mileage rate for business use is 70 cents per mile.

-

Medical Use: The medical mileage rate is used to calculate the deductible expenses for using a vehicle for medical purposes, such as driving to see a doctor or specialist.

-

Moving Use: The moving mileage rate applies to deductible expenses for using a vehicle for moving to a new home due to a job change.

-

Calculation: To calculate the deductible amount, multiply the number of miles driven for the specific purpose (business, medical, or moving) by the IRS standard mileage rate.

-

Alternative to Actual Expenses: Taxpayers can choose to use the standard mileage rate or calculate their actual vehicle expenses, such as gas, oil, and repairs. The method that results in the higher deduction can be used.

-

Record Keeping: It’s essential to keep detailed records of all mileage, including dates, destinations, and the purpose of the trip, to support any deductions claimed.

-

Consistency: If you use the standard mileage rate for a vehicle, you generally cannot depreciate that vehicle.

-

Vehicle Eligibility: Certain vehicles, such as taxis and limousines, are not eligible for the standard mileage rate.

-

Annual Updates: The IRS standard mileage rates are updated annually to reflect changes in fuel costs and other vehicle operating expenses.

Understanding and correctly applying the IRS standard mileage rate can result in significant tax savings for businesses and individuals.

5. How Can I Incorporate Fuel Costs into My Per-Mile Charge in Vietnam?

Incorporating fuel costs into your per-mile charge in Vietnam ensures that you accurately cover one of the most significant expenses in transportation. SIXT.VN can assist in tracking and integrating these costs for precise billing and profitability. According to a report by the General Statistics Office of Vietnam, fuel prices can significantly impact transportation costs.

-

Track Fuel Consumption: Monitor your vehicle’s fuel consumption regularly to determine the average miles per gallon (MPG).

-

Monitor Fuel Prices: Keep an eye on current fuel prices in Vietnam, which can fluctuate. Websites like GlobalPetrolPrices.com provide up-to-date information.

-

Calculate Fuel Cost Per Mile: Divide the current fuel price per gallon by your vehicle’s MPG to find the fuel cost per mile.

-

Include in Per-Mile Rate: Add the fuel cost per mile to other vehicle expenses (maintenance, depreciation, insurance) to determine your total per-mile cost.

-

Update Regularly: Adjust your per-mile charge regularly to reflect changes in fuel prices and consumption.

-

Use Mileage Tracking Apps: Utilize apps like Driversnote, which help track mileage and calculate fuel costs automatically.

-

Consider Location: Factor in that fuel prices may vary by region in Vietnam.

-

Factor in Traffic: High traffic conditions increase fuel consumption, so consider this when setting your rates.

-

Transparency: Clearly communicate how fuel costs are incorporated into your per-mile charge to clients.

-

Compare to Market Rates: Ensure your total per-mile charge remains competitive while covering your expenses.

By carefully incorporating fuel costs into your per-mile charge, you can ensure accurate and fair billing, maintaining profitability while providing transparent pricing to your clients.

6. What Are the Legal and Tax Implications of Charging Mileage to Clients in Vietnam?

Charging mileage to clients in Vietnam involves several legal and tax considerations that businesses must address to ensure compliance. SIXT.VN provides resources and support to help navigate these complexities and maintain accurate financial records. According to Vietnam’s Ministry of Finance, proper documentation is essential for tax reporting.

-

Registration: Ensure your business is properly registered and licensed to provide transportation or related services in Vietnam.

-

Contracts: Use clear and detailed contracts that specify the mileage rate, method of calculation, and any additional charges.

-

Invoicing: Provide accurate invoices that clearly state the mileage charges, distance traveled, and applicable rates.

-

VAT (Value Added Tax): Determine if VAT applies to your mileage charges and include it in your pricing as required by Vietnamese law.

-

Corporate Income Tax (CIT): Mileage charges are considered part of your business income and are subject to CIT.

-

Deductible Expenses: Keep accurate records of vehicle-related expenses, such as fuel, maintenance, and depreciation, as these may be deductible from your taxable income.

-

Personal Income Tax (PIT): If you are an individual providing mileage services, you may be subject to PIT on your earnings.

-

Record Keeping: Maintain detailed records of all mileage, fuel consumption, and related expenses to support your tax filings.

-

Compliance with Labor Laws: If you employ drivers, ensure you comply with all Vietnamese labor laws, including minimum wage and working conditions.

-

Insurance: Ensure your vehicle has adequate insurance coverage for business use, including liability coverage for passenger transport.

-

Consult with Professionals: Seek advice from legal and tax professionals to ensure full compliance with Vietnamese laws and regulations.

By understanding and adhering to these legal and tax implications, businesses can operate legally and efficiently while providing mileage services in Vietnam.

7. How Do I Determine a Competitive Per-Mile Rate in the Vietnamese Market?

Determining a competitive per-mile rate in the Vietnamese market requires a strategic approach, balancing cost coverage with market demand. SIXT.VN offers insights and tools to help you analyze the market and set rates that attract customers while ensuring profitability. According to market research from the Vietnam Chamber of Commerce and Industry, competitive pricing is crucial for success.

-

Research Market Rates: Investigate what other businesses in your industry are charging per mile in Vietnam. Online platforms and industry associations can provide valuable data.

-

Calculate Your Costs: Accurately calculate your vehicle expenses, including fuel, maintenance, insurance, and depreciation, to determine your base cost per mile.

-

Factor in Location: Consider regional differences in fuel prices, traffic conditions, and demand when setting your rates.

-

Assess Customer Willingness to Pay: Conduct market research to understand what customers are willing to pay for mileage services in your area.

-

Offer Competitive Pricing: Set your per-mile rate slightly below the market average to attract more customers, while still ensuring profitability.

-

Provide Value-Added Services: Differentiate your services by offering additional benefits, such as real-time tracking, premium vehicles, or exceptional customer service.

-

Monitor Competitors: Continuously monitor your competitors’ pricing strategies and adjust your rates as needed to stay competitive.

-

Consider Volume Discounts: Offer discounts for high-volume customers or long-distance trips to incentivize business.

-

Transparency: Clearly communicate your pricing structure and the factors that influence your per-mile rate to build trust with customers.

-

Regularly Review and Adjust: Periodically review your per-mile rate and adjust it based on changes in fuel prices, market conditions, and your operating costs.

By following these strategies, you can determine a competitive per-mile rate that attracts customers and ensures your business remains profitable in the Vietnamese market.

8. What Technologies Can Help Track Mileage for Accurate Billing?

Several technologies can help track mileage for accurate billing, ensuring that businesses can efficiently manage and bill for their travel expenses. SIXT.VN integrates with various tracking solutions, providing comprehensive tools for precise mileage management. According to a study by the Ho Chi Minh City Department of Transport, technology adoption improves operational efficiency.

-

GPS Mileage Trackers: These devices use GPS technology to accurately track mileage and routes, providing detailed logs for billing purposes.

-

Mileage Tracking Apps: Mobile apps like Driversnote and MileIQ automatically track mileage using your smartphone’s GPS, making it easy to record trips.

-

Vehicle Telematics Systems: These systems offer advanced features like real-time tracking, vehicle diagnostics, and driver behavior monitoring, providing comprehensive mileage data.

-

Electronic Logging Devices (ELDs): ELDs are used in commercial vehicles to automatically record driving time and mileage, ensuring compliance with regulations.

-

Accounting Software Integration: Integrating mileage tracking tools with accounting software like QuickBooks or Xero streamlines the billing process and ensures accurate financial reporting.

-

Google Maps Timeline: Google Maps can track your location history, providing a timeline of your trips and mileage.

-

Spreadsheets: While manual, spreadsheets can be used to record mileage, but it’s less accurate and more time-consuming.

-

Dashcams with GPS: Some dashcams include GPS tracking, providing video evidence of trips along with mileage data.

-

API Integration: Integrating mileage tracking APIs into your existing systems allows for seamless data transfer and automated billing.

-

Cloud-Based Platforms: Cloud-based mileage tracking platforms offer secure data storage, accessibility from multiple devices, and collaboration features.

By leveraging these technologies, businesses can ensure accurate mileage tracking, streamline billing processes, and maintain compliance with regulations.

9. How Can I Differentiate My Mileage Services to Attract More Clients in Vietnam?

To stand out in the competitive Vietnamese market, differentiating your mileage services is crucial. SIXT.VN provides strategies and solutions to help you offer unique value and attract more clients. A survey by the Vietnam Tourism Advisory Board indicates that customized services enhance customer satisfaction.

-

Offer Premium Vehicles: Provide a fleet of high-quality, well-maintained vehicles that offer superior comfort and reliability.

-

Provide Real-Time Tracking: Offer clients real-time tracking of their trips, providing transparency and peace of mind.

-

Offer Exceptional Customer Service: Train your staff to provide friendly, professional, and responsive customer service.

-

Customize Services: Tailor your mileage services to meet the specific needs of your clients, such as offering specialized transportation for events or tours.

-

Provide Value-Added Amenities: Offer amenities like Wi-Fi, bottled water, and charging ports in your vehicles to enhance the passenger experience.

-

Implement a Loyalty Program: Reward repeat customers with discounts, priority service, or other perks.

-

Offer Multilingual Support: Provide support in multiple languages to cater to a diverse clientele.

-

Ensure Eco-Friendly Options: Offer hybrid or electric vehicles to appeal to environmentally conscious customers.

-

Use Technology to Enhance the Experience: Utilize mobile apps and other technologies to streamline booking, tracking, and communication.

-

Highlight Safety and Reliability: Emphasize your commitment to safety and reliability, ensuring passengers feel secure and confident in your services.

By implementing these differentiation strategies, you can attract more clients and build a loyal customer base in the Vietnamese market.

10. What Are Common Mistakes to Avoid When Charging for Mileage?

When charging for mileage, avoiding common mistakes is crucial to ensure fair billing and maintain good client relations. SIXT.VN offers guidance to help you navigate these challenges and implement best practices. According to the Hanoi Association of Small and Medium Enterprises, transparent billing fosters trust.

-

Inaccurate Mileage Tracking: Failing to accurately track mileage can lead to over or undercharging clients. Use reliable mileage tracking tools.

-

Not Factoring in All Costs: Overlooking expenses like maintenance, insurance, and depreciation can result in undercharging.

-

Lack of Transparency: Not clearly communicating how mileage charges are calculated can lead to misunderstandings and disputes.

-

Ignoring Market Rates: Charging significantly above or below market rates can deter clients or reduce profitability.

-

Failing to Update Rates: Not adjusting mileage rates to reflect changes in fuel prices or operating costs can lead to inaccurate billing.

-

Poor Record Keeping: Inadequate record-keeping can make it difficult to justify mileage charges and comply with tax regulations.

-

Not Complying with Legal Requirements: Failing to comply with local laws and regulations regarding mileage charges can result in legal issues.

-

Ignoring Customer Feedback: Not listening to customer feedback about mileage charges can lead to dissatisfaction and loss of business.

-

Using Inefficient Routes: Taking longer routes than necessary can increase mileage charges and frustrate clients.

-

Not Offering Flexible Options: Failing to offer flexible pricing options or discounts can limit your appeal to a broader range of clients.

By avoiding these common mistakes, you can ensure accurate and fair mileage billing, maintain positive client relationships, and operate your business effectively.

Road trip in Vietnam offering freedom and cultural immersionSIXT.VN is your trusted partner for seamless travel solutions in Vietnam. Contact us today to learn more about our services and start planning your next adventure! Address: 260 Cau Giay, Hanoi, Vietnam. Hotline/Whatsapp: +84 986 244 358. Website: SIXT.VN.

Road trip in Vietnam offering freedom and cultural immersionSIXT.VN is your trusted partner for seamless travel solutions in Vietnam. Contact us today to learn more about our services and start planning your next adventure! Address: 260 Cau Giay, Hanoi, Vietnam. Hotline/Whatsapp: +84 986 244 358. Website: SIXT.VN.