Are you wondering, “Can Lta Be Claimed For International Travel?” Let SIXT.VN be your guide to understanding Leave Travel Allowance (LTA) and how it applies to your travel plans, especially when exploring the beautiful landscapes of Vietnam. LTA, designed to alleviate travel costs, primarily focuses on domestic journeys. But don’t worry! While international travel might not fall under LTA, SIXT.VN offers a range of fantastic travel services in Vietnam to make your vacation seamless and affordable. Discover Vietnam with ease through our airport transfer services, hotel booking assistance, exciting tours, and convenient flight bookings.

1. Decoding Leave Travel Allowance (LTA)

Leave Travel Allowance (LTA), also known as Leave Travel Concession, is a valuable component of many employees’ salary structures in specific regions. It’s designed to help cover the costs associated with traveling during leave periods. Let’s explore the fundamentals of LTA and its purpose.

1.1. LTA: The Basics

LTA is a type of allowance offered to employees that helps offset the cost of travel when they take time off work. Employees who travel to any place within the country and meet specific criteria can claim LTA from their employer. It is usually a part of the Cost to Company (CTC) structure. This benefit is intended to make leisure travel more accessible by reducing the financial burden of transportation expenses.

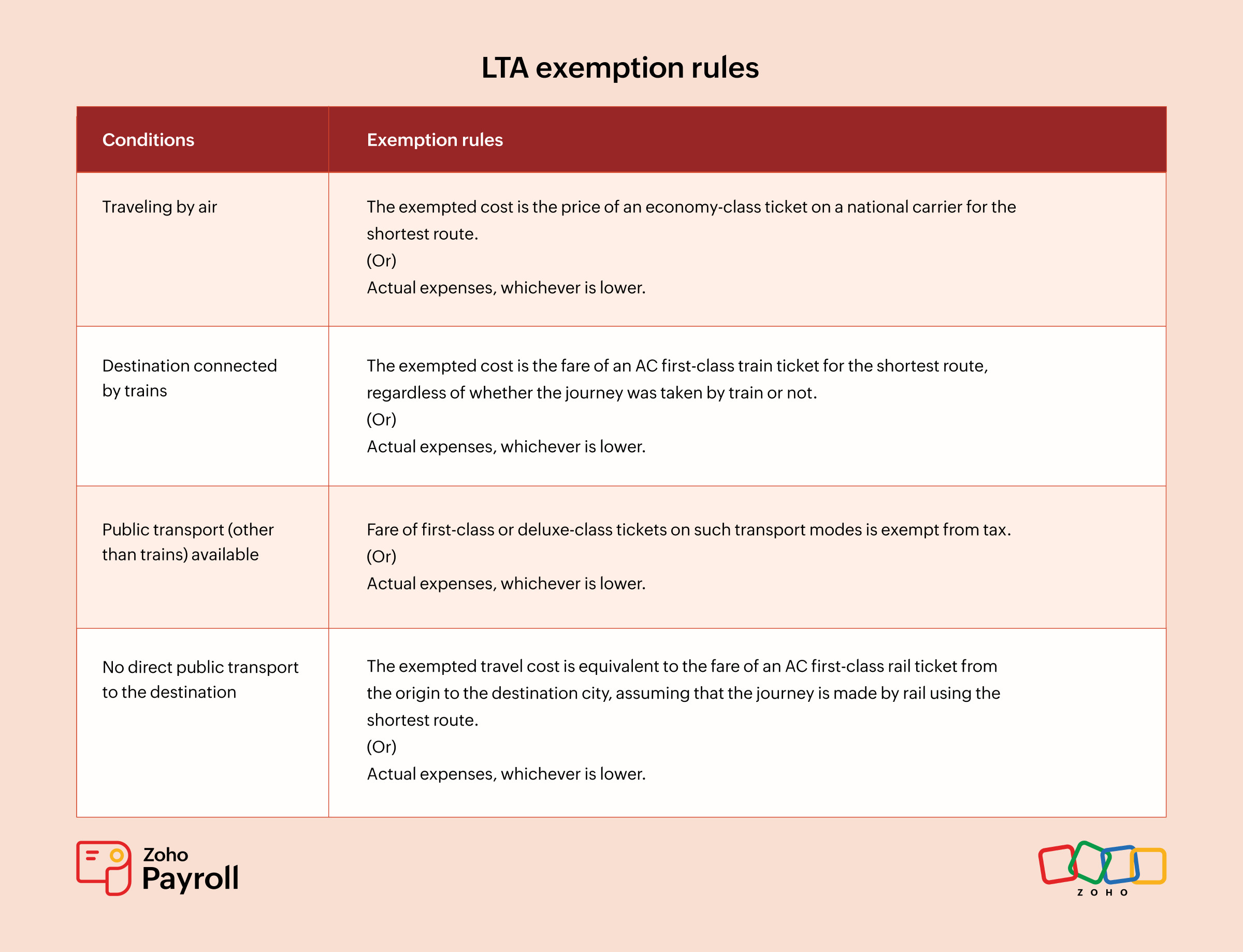

LTA-exemption-rules

LTA-exemption-rules

1.2. What is the Purpose of LTA?

The main purpose of LTA is to encourage employees to take vacations and spend time with their families by making travel more affordable. Employees can take a vacation and have their travel expenses exempt from taxes twice within a four-year block. By providing this allowance, companies can boost morale and productivity, knowing their employees have the support to enjoy their time off. The allowance covers travel expenses for leisure trips, making these costs tax-free for the employee. This helps employees relax and return to work refreshed.

2. Demystifying LTA Eligibility

Understanding who can claim LTA is essential for both employees and employers. Here’s a detailed breakdown of the eligibility criteria.

2.1. Who is Eligible for LTA?

LTA eligibility typically extends to salaried employees who are part of an organization that offers this benefit as part of their compensation package. To claim Leave Travel Allowance, employees need to meet specific criteria, which are as follows:

- Full-time employees of the company

- Employees who have completed a certain period of service (as defined by the company policy)

2.2. Key Conditions for Claiming LTA

To successfully claim LTA, employees must adhere to certain conditions and guidelines set by their employers and the governing tax regulations.

2.2.1. Actual Travel Costs

Employees can claim LTA only for actual travel costs, whether by road, rail or air. They must provide valid proof of these expenses to claim the allowance. Local conveyance, sightseeing, hotel stays, meals, and other non-travel expenses are not eligible for LTA.

2.2.2. Domestic Travel

Employees of a firm can claim LTA for domestic travel. It does not cover expenses from international trips.

2.2.3. Claim Frequency

Employees can claim LTA only for two journeys within a block of four years. These blocks are determined by the government. The current block is from the calendar years 2022-2025, with the previous block being 2018-2021.

2.2.4. Leave from Work

Employees must take leave from work specifically for travel purposes to claim LTA. Your employees must mark the period of travel as ‘leave’.

2.2.5. Inclusion of Family Members

Employees can claim the exemption alone or with their family, which includes the spouse, children and wholly or mainly dependent parents and siblings.

2.2.6. Block Year

Employees are allowed to claim LTA twice in a block of 4 years. The remaining amount after 2 claims is usually carried forward to the next block year based on the company’s pay structure.

3. International Travel and LTA: What You Need to Know

Let’s address the main question: Can LTA be used for international travel? The answer is more nuanced than a simple yes or no.

3.1. Can Leave Travel Allowance Be Claimed for International Travel?

Generally, LTA is designed to cover travel within the domestic boundaries of a country. Employees of a firm can claim LTA for domestic travel. It does not cover expenses from international trips. This means that if you are planning a trip outside of your home country, you typically cannot claim LTA benefits for those expenses.

3.2. Why is LTA Usually Limited to Domestic Travel?

The restriction of LTA to domestic travel is primarily due to the legislative intent behind the allowance. The Government sets specific block years for Leave Travel Allowance (LTA) purposes. The concept of block years was introduced in 1986, with the first block being 1986-1989. LTA is intended to promote local tourism and support the domestic economy.

4. LTA Exemption Rules Explained

Understanding the rules for LTA exemptions can help employees maximize their benefits.

4.1. Key Conditions for LTA Exemption

To claim Leave Travel Allowance (LTA) exemption, employees must meet the following mandatory conditions:

- Valid proof of travel must be provided.

- The travel must be within India; international travel is not covered under LTA.

- LTA can be claimed by employees for themselves, their spouse, children, and dependent family members, such as parents and siblings.

- The exemption is allowed for a maximum of two children born after October 1, 1998. However, there are no restrictions for children born before this date or for multiple births after the first child.

4.2. Required Documentation

To successfully claim an LTA exemption, you must provide specific documents to your employer as proof of travel. Employees can claim LTA only for actual travel costs, whether by road, rail or air. They must provide valid proof of these expenses to claim the allowance. These typically include:

- Travel tickets (air, rail, bus)

- Boarding passes (for air travel)

- Invoices from travel agencies

5. LTA Calculation: How It Works

Understanding how LTA is calculated can help you plan your travel and understand the benefits you can receive.

5.1. Calculating Your LTA

An employer provides Leave Travel Allowance to an employee based on their job position, and this amount varies from company to company. To understand how LTA is calculated, let’s consider an example. Suppose an employer offers an LTA of ₹35,000 to an employee. If the employee spends only ₹25,000 on travel, they will receive ₹25,000 from the employer. However, if the employee spends ₹40,000 on travel, they will still receive only ₹35,000, as that is the maximum LTA set by the employer.

5.2. Examples of LTA Calculation

Let’s illustrate with a couple of scenarios:

- Scenario 1: An employee has an LTA of $1,000. They spend $800 on travel. They can claim $800 as an exemption.

- Scenario 2: An employee has an LTA of $1,000. They spend $1,200 on travel. They can only claim $1,000 as an exemption.

6. Optimizing Travel in Vietnam with SIXT.VN

While LTA might not cover international trips, SIXT.VN can help you make the most of your travel budget in Vietnam.

6.1. Exploring Vietnam with SIXT.VN

Employees can claim LTA only for domestic travel. It does not cover expenses from international trips. Although your LTA might not be applicable here, SIXT.VN makes exploring Vietnam affordable and convenient.

6.1.1. Airport Transfer Services

SIXT.VN offers reliable and comfortable airport transfer services. Booking a private car ensures a stress-free start to your vacation.

6.1.2. Hotel Booking Assistance

SIXT.VN helps you find the best deals on hotels across Vietnam, ensuring comfortable accommodations that fit your budget.

6.1.3. Exciting Tours

Discover Vietnam’s rich culture and stunning landscapes with SIXT.VN’s curated tours. Whether you’re interested in historical sites, natural wonders, or culinary adventures, we have something for everyone.

6.1.4. Convenient Flight Bookings

SIXT.VN simplifies the process of booking flights within Vietnam, making it easier to explore different regions of the country.

6.2. How SIXT.VN Enhances Your Travel Experience

SIXT.VN focuses on making your travel experience as seamless and enjoyable as possible.

6.2.1. Personalized Service

We offer personalized travel advice and support to help you plan the perfect trip.

6.2.2. Local Expertise

Our team has extensive knowledge of Vietnam, ensuring you get the best recommendations and insider tips.

6.2.3. Reliable Support

From booking to travel, SIXT.VN provides reliable support to address any questions or concerns.

7. Maximizing Your LTA Benefits

Even though LTA is typically for domestic travel, here are some tips to make the most of it.

7.1. Planning Domestic Travel

If you have LTA benefits, plan domestic trips to take advantage of the allowance. Consider destinations within your country that you’ve always wanted to visit.

7.2. Utilizing LTA for Family Trips

Employees can claim the exemption alone or with their family, which includes the spouse, children and wholly or mainly dependent parents and siblings. Plan family vacations within the country to maximize the value of your LTA. This allows you to spend quality time with loved ones while also reducing your tax burden.

7.3. Keeping Accurate Records

To successfully claim your LTA, keep detailed records of all travel-related expenses. This includes:

- Tickets and boarding passes

- Invoices from travel agencies

- Any other relevant documentation

8. Understanding LTA and Tax Implications

It’s crucial to understand how LTA affects your taxes.

8.1. Is Leave Travel Allowance Taxable?

The amount claimed as Leave Travel Allowance is exempt from tax under the old tax regime if the conditions specified by the government are met. However, for employees who opt for the new tax regime, the entire LTA amount will be fully taxable.

8.2. Navigating Tax Regulations

Understanding these nuances is important to guide your employees in availing tax benefits applicable to them. Stay updated with the latest tax laws to make informed decisions about your LTA claims.

9. Carryover of Unclaimed LTA

What happens if you don’t use your LTA in a given year?

9.1. Can Unclaimed LTA Be Carried Forward?

If an employee has not claimed their LTA exemption for one or two journeys within a 4-year block, they can carry over one unclaimed exemption to the next block. However, an employee must use this in the first calendar year of the new block.

9.2. Rules for Carryover

Employees are allowed to claim LTA twice in a block of 4 years. The remaining amount after 2 claims is usually carried forward to the next block year based on the company’s pay structure. Be sure to check your company’s policy on LTA carryover.

10. LTA Block Year: What It Means for You

The LTA block year is a crucial concept for understanding how often you can claim this benefit.

10.1. Understanding Block Years

The Government sets specific block years for Leave Travel Allowance (LTA) purposes. The concept of block years was introduced in 1986, with the first block being 1986-1989. The current LTA block year is 2022-2025.

10.2. Planning Your Claims

It is important for employers to understand these block years to ensure that employees claim their LTA benefits within the designated period. Strategically plan your travel within these block years to maximize your LTA benefits.

11. LTA vs. LTC: What’s the Difference?

LTA and LTC are often used interchangeably, but there are subtle differences.

11.1. Key Differences Between LTA and LTC

LTA (Leave Travel Allowance) and LTC (Leave Travel Concession) essentially serve the same purpose but are used in different sectors. LTA is the term commonly used in the private sector, while LTC is used in the public sector. Both allowances help employees save on travel expenses and reduce their taxable income.

11.2. Which One Applies to You?

Your employment sector typically determines whether you receive LTA or LTC. Check with your HR department to clarify which one applies to you.

12. Leave Travel Allowance (LTA): Benefits for Employees

LTA is a valuable part of the salary package that helps reduce taxable income. Here’s how it benefits employees:

- Employees can claim LTA for their personal travel fares or tickets within India.

- By submitting travel-related bills for journeys, employees can lower their taxable income.

- LTA can also cover travel expenses for family members such as parents, siblings, spouses and children, if they travel with the employee.

13. Common Misconceptions About LTA

Let’s clear up some common misunderstandings about LTA.

13.1. Myth: LTA Covers All Travel Expenses

Fact: LTA typically covers only the cost of transportation, not accommodation, meals, or sightseeing.

13.2. Myth: LTA Can Be Claimed for Any Trip

Fact: LTA is usually restricted to domestic travel and must be supported by valid proof of travel.

14. How to Claim LTA: A Step-by-Step Guide

Here’s a simple guide to help you claim your LTA.

14.1. Step 1: Plan Your Travel

Plan your trip well in advance to ensure you can gather all the necessary documentation.

14.2. Step 2: Gather Documentation

Collect all travel-related documents, including tickets, boarding passes, and invoices.

14.3. Step 3: Submit Your Claim

Submit your LTA claim to your employer along with the required documentation.

14.4. Step 4: Verification

Your employer will verify the documents and process your LTA claim.

15. Benefits of Using SIXT.VN for Your Vietnam Trip

Discover how SIXT.VN can make your trip to Vietnam unforgettable.

15.1. Wide Range of Services

From airport transfers to hotel bookings and curated tours, SIXT.VN offers a comprehensive range of services.

15.2. Competitive Pricing

SIXT.VN provides competitive pricing, ensuring you get the best value for your money.

15.3. Customer Support

Our dedicated customer support team is available to assist you with any questions or concerns.

16. Real-Life Scenarios: LTA in Action

Let’s look at some real-life scenarios to illustrate how LTA works.

16.1. Scenario 1: Family Vacation

An employee plans a family vacation to explore historical sites, natural wonders, or culinary adventures within their country and uses LTA to cover the transportation costs.

16.2. Scenario 2: Solo Travel

An employee takes a solo trip to a scenic destination and claims LTA for the travel expenses.

17. Staying Updated on LTA Regulations

Keeping up with the latest LTA regulations is crucial for maximizing your benefits.

17.1. Official Sources

Refer to official government websites and tax authorities for the most accurate and up-to-date information.

17.2. HR Department

Consult your HR department for clarifications on your company’s LTA policies and any recent changes.

18. Legal and Regulatory Aspects of LTA

Understanding the legal and regulatory framework of LTA ensures compliance and accurate claims.

18.1. Compliance Requirements

Ensure you meet all compliance requirements when claiming LTA to avoid any issues with tax authorities.

18.2. Common Pitfalls

Be aware of common pitfalls, such as submitting incorrect documentation or claiming ineligible expenses.

19. Alternative Travel Benefits

If LTA isn’t suitable for your travel plans, explore alternative travel benefits offered by your employer.

19.1. Travel Allowances

Some companies offer general travel allowances that can be used for both domestic and international travel.

19.2. Company-Sponsored Trips

Take advantage of company-sponsored trips or retreats to explore new destinations.

20. Future Trends in LTA

What does the future hold for LTA?

20.1. Potential Changes

Stay informed about potential changes to LTA regulations and how they might impact your benefits.

20.2. Impact on Employees

Understand how these changes could affect your travel planning and tax obligations.

21. FAQs About Leave Travel Allowance

Let’s address some frequently asked questions about LTA.

21.1. What is a leave travel allowance?

Leave Travel Allowance (LTA) is a type of allowance provided by employers to employees in India, allowing them to claim tax exemptions on expenses incurred while traveling within the country. LTA covers travel costs for the employee and their family, such as airfare, train, or bus tickets, but excludes other expenses like accommodation, food, or sightseeing.

21.2. Can employees claim LTA for multiple trips in a year?

Yes, employees can claim LTA for up to two trips in a block of four calendar years.

21.3. What is the LTA exemption in the new tax regime?

As per the new tax regime, there is no LTA exemption applicable for employees for the financial year 2024-25.

21.4. Is there any difference between LTA and LTC?

LTA (Leave Travel Allowance) and LTC (Leave Travel Concession) essentially serve the same purpose but are used in different sectors. LTA is the term commonly used in the private sector, while LTC is used in the public sector. Both allowances help employees save on travel expenses and reduce their taxable income.

21.5. Can LTA be claimed for international travel?

No, LTA is generally designed for domestic travel within the country.

21.6. What documents are required to claim LTA?

Typically, you need travel tickets, boarding passes, and invoices from travel agencies.

21.7. How is LTA calculated?

LTA is calculated based on your job position and can vary from company to company.

21.8. What is an LTA block year?

The LTA block year is a four-year period during which you can claim LTA benefits.

21.9. Can I carry over unclaimed LTA?

Yes, you can carry over one unclaimed exemption to the next block, but it must be used in the first calendar year of the new block.

21.10. What if I spend more than my LTA?

You can only claim up to the amount of your LTA, even if you spend more on travel.

Conclusion: Plan Your Dream Trip to Vietnam with SIXT.VN

While LTA may not cover international travel, don’t let that stop you from exploring the world. Plan your dream trip to Vietnam with SIXT.VN and enjoy a seamless, affordable, and unforgettable travel experience. From airport transfers to exciting tours, we have everything you need to make your vacation perfect.

Ready to explore Vietnam? Contact SIXT.VN today!

- Address: 260 Cau Giay, Hanoi, Vietnam

- Hotline/Whatsapp: +84 986 244 358

- Website: SIXT.VN

Let SIXT.VN take care of your travel needs, so you can focus on creating lasting memories.